Market’s Week in Review

January 9 - January 15, 2026

Short-Term ETF Price Targets

ETF | Short-Term Target |

|---|---|

SPY | $696 |

QQQ | $630 |

Week’s Market Performance

Index | Current Level | Percent Change: Week | Percent Change: Year-to-Date |

|---|---|---|---|

S&P 500 | 6,944.47 | -0.31% | +1.45% |

NASDAQ 100 | 25,547.56 | -0.85% | +1.18% |

VIX | 15.8 | +9.04% | +5.12% |

10-Year Treasury Yield | 4.169% | -0.14% | +0.07% |

Gold | $4,605.65 | +2.11% | +6.62% |

Oil | $59.00 | -0.21% | +2.71% |

Market News

EVs Lose Center Stage as Detroit Auto Show Shifts Back to Gas and Hybrids

The North American International Auto Show in Detroit, once a showcase for electric vehicles with a dedicated EV test track, has refocused on hybrids and gas-powered models as U.S. automakers pull back from aggressive electrification plans under President Donald Trump’s pro-fossil fuel agenda. Both indoor test tracks now feature gasoline, hybrid and electric vehicles, reflecting what show chairman and dealer Todd Szott calls changes in the EV landscape and a new emphasis on “consumer choice.” Industry analysts warn that this shift could weaken the global competitiveness of American automakers as China and Europe post far stronger growth in electrified vehicle sales than the modest 1% rise seen in the U.S. last year. President Trump, during a visit to Ford’s River Rouge Complex in Dearborn, touted his rollback of Biden-era EV targets, cuts to EV tax credits, efforts to block charging funds, and weakened fuel economy and gas mileage rules, saying he ended a “radical left war on oil and gas” while insisting he still “love[s] electric cars.”

Automakers are absorbing heavy financial hits from earlier EV bets: Ford recently announced 19.5 billion dollars in charges tied to electrification and ending production of the all‑electric F-150 Lightning, while General Motors booked about 6 billion dollars in EV-related charges and scaled back some commitments amid a difficult 2025 for former market leader Tesla. Some company executives, like Ford marketing manager Shawn Strain, maintain that EVs remain the “future of the company” even if their promotion is less overt. At the show, Michigan Gov. Gretchen Whitmer warned that China is making “major headway” and aims to dominate every part of auto manufacturing, having captured significant market share nearly everywhere except the U.S. and Canada. On a separate panel, former Transportation Secretary Pete Buttigieg argued that Trump cannot stop EVs from becoming the leading automotive technology but “can stop America from being the leader in that technology,” urging industry to move in a different direction.

Young Adults, Legal Gaps Drive Surge in Online Prediction Market Betting

Trading activity on prediction markets is surging, and analysts say 18- to 20-year-olds who are too young for legal sports betting in most states may be a key driver of the boom. Truist analyst Barry Jonas cited data indicating that young adults are flocking to platforms such as Kalshi and Polymarket, which accept users 18 and older, unlike many online sportsbooks that require a minimum age of 21. Data from HoldCrunch, founded by a former FanDuel executive, show Kalshi now takes more trades on college football than on the NFL or NBA, with college football accounting for 32% of handle in the week ended Jan. 4, compared with 24% for the NFL and 22% for the NBA. These prediction markets, which allow users to bet on outcomes ranging from politics to pop culture and sports, are filling a gap in states where online sports betting remains illegal and offering an alternative even in states where it is permitted.

The rapid growth has triggered concern from regulators and sports officials, with NCAA President Charlie Baker urging the Commodity Futures Trading Commission to remove college sports from prediction market offerings until stronger safeguards are adopted. Juice Reel, an app that tracks wagering activity, reports higher adoption of prediction markets in states without legal sports betting, such as California and Texas, while also noting unexpectedly high usage in New York, where financial traders may be comfortable with futures and options-style products. Juice Reel founder Ricky Gold said “some of the biggest and best bettors are going to prediction markets because they’re limited to smaller bets by the sportsbooks,” with predictions making up just 1% of bets tracked but 13% of total handle. Jonas concluded that prediction markets “amplify bettor skill and variance,” producing larger downside for bettors with small bankrolls and higher potential upside for those with more capital.

Mortgage Costs Hit Three-Year Low as Bond Purchases Nudge Rates Down

The average 30-year fixed mortgage rate fell to 6.06% for the week ending January 15, the lowest level since September 2022, according to Freddie Mac. Economists say the decline is beginning to unlock a housing market that has been largely frozen as owners clung to ultra-low pandemic-era rates. Freddie Mac chief economist Sam Khater said purchase and refinance applications have jumped, calling housing activity “improving” and “poised for a solid spring sales season.” Compared with a year ago, when the average rate was 7.04%, a buyer of a 450,000 dollar home with 20% down would now save about 230 dollars a month, or roughly 84,000 dollars over a 30-year loan.

The move lower comes after President Donald Trump urged the purchase of up to 200 billion dollars in mortgage bonds to push borrowing costs down, a program real estate professor Susan Wachter says is already visible in rate data, even if the full amount has not yet been deployed. The easing in rates appears to be weakening the “lock-in effect,” as new analysis from Realtor.com shows the share of homeowners with mortgage rates above 6% has now surpassed those with ultra-low sub‑3% loans, reducing the incentive to stay put. Existing-home sales rose 5.1% in December from the prior month, the fourth straight monthly gain and the longest such streak since mid-2020, according to the National Association of Realtors, even as the median sales price climbed to 405,400 dollars and marked its 30th consecutive year-over-year increase. Redfin chief economist Daryl Fairweather said a more mobile housing market can boost the broader economy and quality of life by allowing people to change jobs, form households and adjust living arrangements, even if overall affordability remains strained.

Amazon Fights Saks Bankruptcy Plan After $475 Million Bet on Neiman Marcus Sours

Amazon has asked a federal judge to reject Saks Global’s proposed bankruptcy financing plan, arguing in court filings that it unfairly harms creditors and pushes the tech giant further down the repayment line. The company invested 475 million dollars in late 2024 to back Saks’ 2.7 billion dollar acquisition of Neiman Marcus, in exchange for Saks selling its products on Amazon’s site and using Amazon’s technology and logistics services. Amazon’s lawyers wrote that the equity stake is now “presumptively worthless” after Saks “burned through hundreds of millions of dollars in less than a year” and racked up substantial unpaid invoices to retail partners. At a hearing in U.S. Bankruptcy Court in Houston, Judge Alfredo Perez nonetheless allowed Saks to begin drawing on 1.75 billion dollars in new bankruptcy financing, while reserving judgment on Amazon’s objections.

As part of the original deal, Saks launched a “Saks at Amazon” storefront featuring luxury fashion and beauty products and agreed to pay referral fees guaranteeing at least 900 million dollars to Amazon over eight years. Amazon warned in its filing that Saks’ restructuring plan loads new debt onto parts of the company that previously had none, further diluting what Amazon and other creditors might recover. The company said it “hopes” Saks will address its concerns but threatened to seek “more drastic remedies,” including the appointment of an examiner or trustee, if that does not happen. The Neiman Marcus transaction also brought in other tech-linked investors such as Salesforce as minority shareholders, though it remains unclear whether they will join Amazon in challenging the plan.

Spotify Raises U.S. Premium Price Again as New Leadership Era Begins

Spotify will raise the price of its U.S. Premium subscription by 1 dollar to 12.99 dollars per month starting with February bills, marking the streamer’s third U.S. price hike since mid‑2023. The company said in a blog post that customers will be notified by email in the coming weeks, explaining that the increase is needed to “keep delivering a great experience.” Premium prices are also rising in Estonia and Latvia to 11.99 euros, roughly 14 dollars, as part of the latest round of adjustments. Shares of Spotify closed nearly 4% lower on Thursday after the announcement, adding market pressure following earlier guidance that fell short of analyst expectations on fourth‑quarter revenue and subscriber growth.

The price move comes as Spotify navigates a major leadership transition and ongoing controversy around its strategy and investments. Co‑founder Daniel Ek stepped down as CEO at the start of 2026, handing control to co‑chief executives Gustav Söderström and Alex Norström after the change was announced in September. The company has expanded into podcasts, video and artificial intelligence features, even as some artists, including King Gizzard & the Lizard Wizard, Deerhoof, Hotline TNT, Xiu Xiu and Massive Attack, have removed their music in protest over Ek’s investment in defense technology firm Helsing. The latest price increase follows earlier U.S. Premium hikes to 10.99 dollars in July 2023 and 11.99 dollars in June 2024, underscoring Spotify’s push to improve margins as it invests heavily in new content and technology.

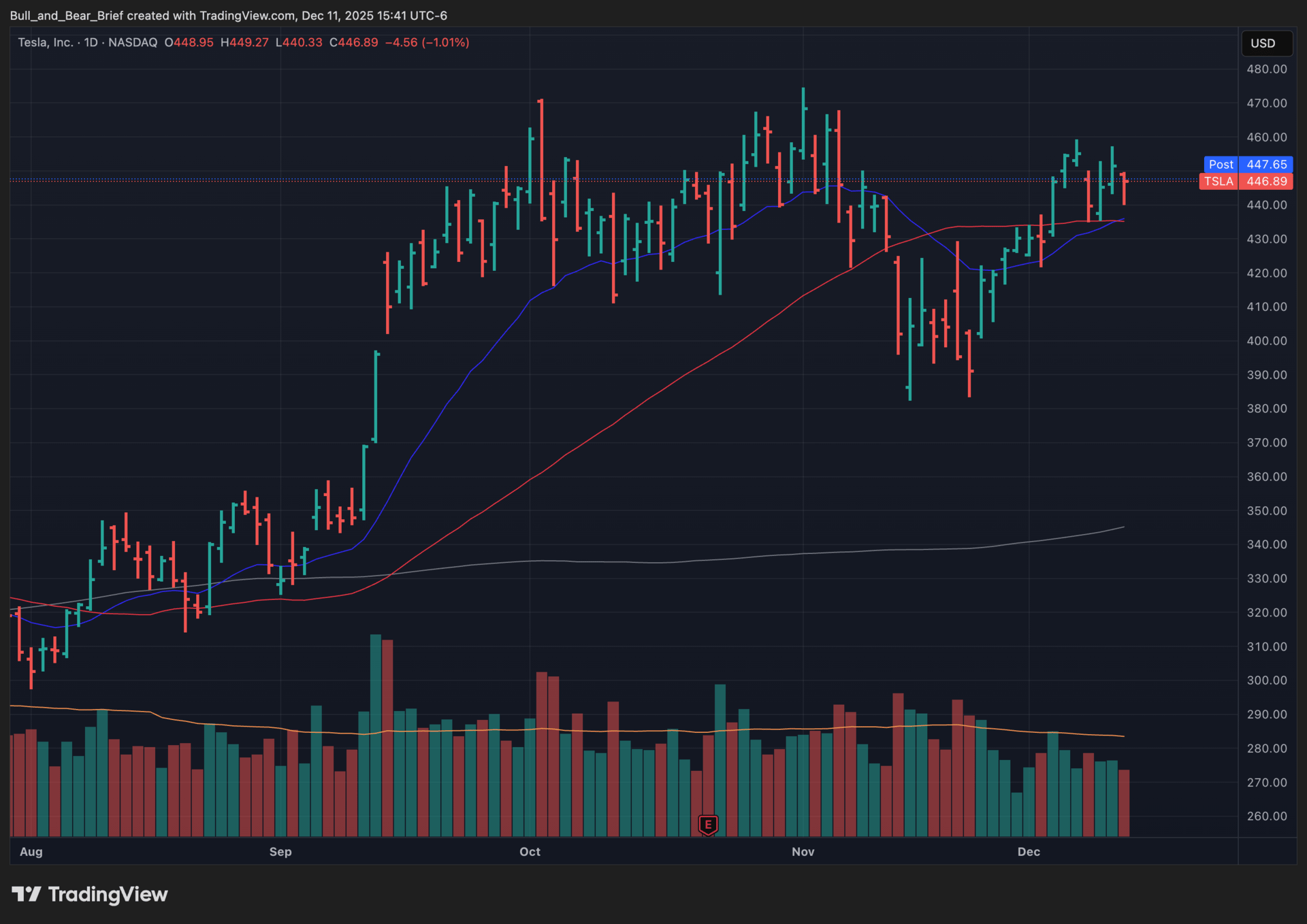

Editor’s Chart of the Day

Spotlighting Tesla Inc. (TSLA) — Tesla designs and manufactures electric vehicles, energy storage solutions, and solar products, generating most of its revenue from automotive sales while also building out a growing high-margin software and services stack around autonomous driving and energy management. The company operates globally with Gigafactories across the U.S., Europe, and China that support its vehicle, battery, and energy businesses at scale.

Following a difficult stretch characterized by declining comparable sales and pressured earnings, TSLA shares have spent much of the year trading sideways within a broad range. Recent attempts to break out to new highs have stalled as investors reassess the company’s medium-term fundamentals, leaving the stock sensitive to shifts in sentiment rather than clear, decisive trends. A decisive move below well-watched support in this range would raise the probability of a more extended downturn, with TSLA likely trading more in line with broader consumer discretionary risk appetite if the macro backdrop weakens further.

Even so, over the trailing 12 months, Tesla has significantly underperformed the S&P 500, with the stock up only low single digits versus a high‑teens total return for the index, despite its historical role as a leading EV name with a strong global brand.. Operationally, management continues to prioritize cost reductions, factory efficiency, and disciplined capital allocation while pushing software and services—such as Full Self-Driving (FSD) features—to deepen monetization of the installed base. Leadership has also emphasized accelerating product cycles and manufacturing innovation (including next‑generation platforms and more automated production) as key levers to restore earnings momentum.

Looking ahead, many analysts model a re‑acceleration toward mid‑teens revenue growth and strong earnings leverage into 2026, driven by higher volumes, better factory utilization, and an increasing mix of higher‑margin software and energy revenue, though Tesla has not provided explicit 2026 revenue or EPS guidance. Upside to these targets would likely depend on successful ramp of refreshed vehicle models, further cost declines in batteries, and scaling of FSD and energy-storage deployments.

If consumer demand in the EV category softens further and pricing pressure intensifies, management believes Tesla’s cost position, brand strength, and diversified revenue mix would allow it to defend share and protect profitability better than peers, though growth could still moderate versus current expectations. For long-term investors, the key will be waiting for technically healthier setups—orderly pullbacks that hold key moving averages—combined with major catalysts such as next‑gen vehicle launches, regulatory or commercial breakthroughs in autonomous driving, or a significant step-up in energy and storage profits to reestablish sustained leadership in the tape.

Major Earnings

Interactive Brokers Group, Inc. (IBKR) – January 20, 2026, After Market Close

Financial Trends: Interactive Brokers is expected to deliver solid double-digit annual revenue growth with EPS projected around the mid‑single digits in dollars for 2025 and further expansion in 2026 as higher rates and client balances support net interest income.

Strategic Initiatives: Management continues to grow its global electronic brokerage franchise by adding products, expanding internationally, and leveraging technology to drive low-cost execution and higher client engagement.

Key Metrics: Investors will focus on annual net interest income, commission revenue, total DARTs, account growth, client equity balances, and EPS progression versus current street estimates.

Progress: Recent quarters have featured strong revenue growth and consistent EPS beats as higher client balances and rate tailwinds offset elevated expenses, signaling improving operating leverage.

Focus Areas: The call will likely center on 2026 EPS guidance, client growth trends, net interest margin sustainability as rate expectations shift, and capital return policies including potential dividend increases or buybacks

Risks Potential: Key risks include lower trading activity, declining interest rates pressuring net interest income, competitive pricing from rival brokers, and regulatory changes affecting order routing or payment for order flow

Concerns: With the stock already reflecting robust growth, investors are sensitive to any slowdown in annual revenue or EPS growth, compression in interest-related income, or rising expense guidance that could cap margin expansion.

Market Trends: IBKR is leveraged to secular growth in self-directed and active trading, electronic brokerage, and global market access, but near-term sentiment will track rate expectations and retail/institutional trading volumes.

3M Company (MMM) – January 20, 2026, Before Market Open

Financial Trends: 3M is projected to deliver low-single-digit annual revenue growth with 2025 adjusted EPS around 7.95–8.05 dollars and modest EPS expansion modeled into 2026 as cost actions support margin stabilization.

Strategic Initiatives: Management is simplifying the portfolio, executing restructuring and productivity programs, and reallocating capital toward higher-growth, higher-margin franchises while working through significant legacy legal liabilities.

Key Metrics: Investors will key on full-year revenue, adjusted EPS versus guidance, segment sales, operating margin trajectory, free-cash-flow generation, and quantified legal and restructuring charges.

Progress: Recent quarters have shown improving adjusted margins and EPS guidance raises alongside steady organic sales, even as the company absorbs sizable litigation-related costs.

Focus Areas: The call will focus on 2026 earnings and margin outlook, cash-flow conversion after legal outflows, progress on portfolio and cost programs, and demand trends across industrial, electronics, and consumer markets.

Risks Potential: Key risks include softer global industrial production, end-market weakness in electronics and consumer, execution risk on restructuring, FX headwinds, and uncertainty around the timing and magnitude of legal payouts.

Concerns: Investors remain concerned that ongoing legal liabilities and restructuring expenses could cap EPS growth, constrain free cash flow, and limit capital returns despite operational improvements.

Market Trends: 3M’s setup is tied to an industrial cycle showing gradual but uneven recovery, with reshoring and infrastructure investment tailwinds offset by macro uncertainty and cautious corporate spending.

Intel Corporation (INTC) – January 22, 2026, After Market Close

Financial Trends: Intel is in a multi-year turnaround with 2025 still reflecting depressed profitability and consensus modeling a return to positive but modest EPS and mid-single-digit revenue growth in 2026 as demand recovers.

Strategic Initiatives: Management is executing its IDM 2.0 strategy, investing heavily in leading-edge process technology, foundry capacity, and AI/data-center products to regain process leadership and build a global manufacturing platform.

Key Metrics: Investors will focus on full-year revenue, EPS, gross margin, data-center and AI-related revenue, foundry-services progress, and capex intensity tied to new fabs and nodes.

Progress: Recent results show revenue stabilization and occasional EPS upside, but margins remain compressed as Intel balances heavy investment with only gradual recovery in PCs and servers

Focus Areas: The call will likely center on 2026 margin and EPS trajectory, AI accelerator and server demand, timing and scale of foundry customer wins, and updates on government incentive support.

Risks Potential: Key risks include execution on advanced nodes, slower-than-expected PC or data-center spending, intense competition from NVIDIA, AMD, and leading foundries, and the financial strain of elevated capex.

Concerns: Investors are sensitive to any sign of delayed process ramps, weaker AI or server demand, or guidance that implies a slower path to margin recovery than current models assume.

Market Trends: Intel’s outlook is tightly linked to AI infrastructure build-outs, cloud and enterprise spending, and semiconductor reshoring policies, set against cyclical swings in PCs and traditional servers.

Meet Evan Buenger

Evan Buenger, Editor of the Bull and Bear Brief

From a young age, Evan was fascinated by the stock market. At just 11 years old, he received a Wall Street Journal subscription for his birthday, sparking a lifelong passion for investing. Evan spent his formative years studying the strategies and philosophies of legendary investors like Paul Tudor Jones, Stanley Druckenmiller, and George Soros, absorbing their wisdom and developing his own unique approach to the markets.

As Evan's knowledge grew, he began to incorporate the time-tested, technically-based strategies of trading legends like William O'Neil and Richard Wyckoff into his own investment framework. By borrowing elements from each and rigorously testing them in real-time, Evan created a powerful conglomerate strategy that encompasses fundamentals, technicals, and macroeconomics.

Today, Evan is a professional trader and was a top contender in the 2020 US Investing Championship. His extraordinary performance, with a 141.8% return, is a testament to his studious background, well-informed approach, and unwavering dedication to his craft.

At the core of Evan's strategy is identifying stocks that benefit from sector trends and rotation. By combining fundamental analysis with a focus on relative strength and advanced technical analysis techniques, Evan is able to identify the stocks that are most likely to move higher or lower over the intermediate term.

While he keeps a close eye on macroeconomic trends, his willingness to adapt to changing market conditions, as well as his developed ability to know when to and not to act in a fast-moving market, is what sets him apart. Evan has consistently demonstrated his ability to navigate even the most challenging investment environments. His impressive track record and unique perspective make him a valuable voice in the world of finance, and he is thrilled to have the opportunity to share his insights and expertise with subscribers of the Bull and Bear Brief.

Subscribe to Stock Portfolio Recommendations Newsletter to read the rest.

Become a paying subscriber of the Bull and Bear Brief: Stock Portfolio Recommendations Newsletter to get access to this post and other subscriber-only content.

Upgrade to Stock Portfolio Recommendations NewsletterA subscription gets you:

- Expert-curated stock trades delivered weekly to strategically build your wealth-generating portfolio

- Real-time position management with timely alerts on existing holdings—ensuring you capture profits and minimize losses with precision timing

- Monthly Q&A where we address paid subscriber questions, examine real-world scenarios, and discuss current market conditions

- Regular reviews of both successful and unsuccessful trade recommendations, analyzing what worked, what didn't, and the lessons we can extract