Market’s Week in Review

August 25-August 29, 2025

Short-Term ETF Price Targets

ETF | Short-Term Target |

|---|---|

SPY | $633 |

QQQ | $559 |

Week’s Market Performance

Index | Current Level | Percent Change: Week | Percent Change: Year-to-Date |

|---|---|---|---|

S&P 500 | 6,460.26 | -0.10% | +9.84% |

NASDAQ 100 | 23,415.42 | -0.35% | +11.44% |

VIX | 15.38 | +8.16% | -11.20% |

10-Year Treasury Yield | 4.25% | -0.73% | -7.04% |

Gold | $3,452.52 | +2.35% | +31.56% |

Oil | $63.99 | +0.72% | -10.86% |

Market News

Trump Administration Considers National Housing Emergency Amid Affordability Crisis

US Treasury Secretary Scott Bessent revealed that the Trump administration is exploring the declaration of a national housing emergency this fall, aiming to make housing affordability a central issue in the lead-up to the 2026 midterm elections. Speaking to the Washington Examiner, Bessent emphasized that the White House is seeking solutions that do not interfere with state and local authority, while also hinting that officials are examining options such as standardizing building and zoning codes and lowering closing costs. This move comes as President Donald Trump repeatedly resorts to emergency declarations to advance policies without Congressional approval, with some facing legal challenges in federal courts.

The focus on housing follows a period where the COVID-19 pandemic exacerbated financial disparities and dramatically increased costs for renters and homebuyers. Trump, who discussed the issue during the 2024 campaign, has advocated for opening federal lands for residential development and cutting regulations to make housing more affordable. The subject also emerged as a key debate point against former Vice President Kamala Harris, who proposed substantial tax credits and down payment assistance for buyers. As the administration studies policy responses, the broader goal is to address high interest rates and regulatory barriers, which Trump argues have harmed the housing market and burdened Americans nationwide.

Federal Reserve Governor Lisa Cook Fights Dismissal as Trump’s Move Sets Stage for Court Clash Over Fed Independence

Federal Reserve Governor Lisa Cook has filed a lawsuit in federal court seeking to block President Donald Trump’s attempt to remove her from the central bank’s Board of Governors. The suit, filed in Washington, DC, asks a judge to rule that Trump’s effort to oust her is unlawful and allow her to remain in her position, which plays a crucial role in setting interest rates. A hearing on Cook’s request for a temporary restraining order is scheduled before Judge Jia Cobb. The case marks a potentially pivotal legal battle, with Cook’s lawyers arguing that the president’s action could undermine the historic independence of the Federal Reserve and seeking emergency relief to prevent Trump from filling her seat.

At the heart of the case are allegations of mortgage fraud—first made by Federal Housing Finance Agency Director Bill Pulte—against Cook, which Trump cited as cause for her removal. Cook’s attorneys contend she was fired without due process, arguing the accusations predate her confirmation and have never been investigated or proven. The White House insists the dismissal is justified to protect the Fed's integrity, while Cook calls the scenario a politically-motivated attempt to change central bank leadership and warns about the precedent it would set. Legal experts note the Supreme Court has previously protected the Fed’s independence, but recent court decisions have generally favored expanded presidential power over federal agency leadership. The outcome could determine whether Cook can vote at the Fed’s upcoming policy meeting, where a much-anticipated interest rate cut is expected.

AI Reshapes Entry-Level Job Market, Challenges Recent Grads

Artificial intelligence tools, like ChatGPT, are disrupting traditional job searches, especially for recent college graduates. Olivia Fair, a recent grad, faces new hurdles as companies replace positions like TV production transcription with AI-powered automation, leaving fewer roles for humans. Data from Indeed’s director of economic research, Laura Ullrich, reveals a 6.7% drop in job postings in the past year, with recent grads struggling the most. However, Ullrich attributes only part of this decline to AI, citing pre-existing trends such as overhiring during the 2021-22 post-pandemic recovery and broader economic uncertainty. Labor economist David Autor of MIT cautions against alarmist predictions, warning instead of a nuanced future where entry-level skill-building could be eroded, but a total jobs collapse is unlikely.

Many routine, screen-based jobs—such as coding, accounting, customer service, and design—are at risk of being automated, with Ullrich’s research showing that 30% of job skills could be partially handled by AI. Sectors requiring empathy, physical presence, or creative thinking—like healthcare, teaching, and the trades—remain less susceptible to substitution. New roles, impossible to predict today, are expected to emerge as technology evolves. Meanwhile, experts advise young job seekers to network creatively and seek internships to navigate these ongoing changes, while reiterating that, despite inevitable displacement in some fields, AI may ultimately enhance medicine, energy, and agriculture rather than render entire populations jobless.

Tesla Faces Sharp European Decline as BYD Surges Amid Intensifying EV Battle

Tesla's sales in Europe dropped precipitously in July 2025, marking a seventh consecutive monthly decline for the American automaker. According to the European Automobile Manufacturers Association (ACEA), new Tesla registrations fell 40% year-on-year to 8,837 vehicles, while Chinese electric vehicle rival BYD soared with a 225% increase, reaching 13,503 new registrations. Despite Elon Musk’s efforts to reposition Tesla as a technology and innovation leader, the brand is grappling with fierce competition, reputation challenges linked to Musk’s rhetoric and U.S. political associations, and a lack of significant vehicle updates. Tesla’s falling numbers come as overall battery electric car sales in Europe continue to climb, intensifying the pressure from both established automakers and aggressive Chinese entrants.

The surge by BYD highlights a broader trend, with Chinese brands capturing a record market share of over 5% in Europe during the first half of the year, according to JATO Dynamics. Other non-Chinese automakers like Stellantis, Hyundai, Toyota, and Suzuki also posted year-on-year declines, while some European brands such as Volkswagen, BMW, and Renault registered gains. Analysts, such as Kepler Cheuvreux’s Thomas Besson, observe that Tesla’s aging model lineup and underwhelming launches, particularly the Cybertruck, have contributed to sluggish sales growth, even as the company promises a new affordable EV for late 2025. BYD’s growth was fueled by aggressive pricing and rapid showroom expansion across the continent, signaling a shifting landscape in the European electric vehicle market.

Corporate Tax Overhaul Yields Billions in Cash Windfalls Across U.S. Industries

Large U.S. corporations are reporting significant reductions in cash tax payments following President Trump’s newly enacted tax law, which retroactively accelerates or expands deductions for research, interest payments, and equipment purchases. Major companies like Verizon Communications, Lumen Technologies, and Diamondback Energy expect to save billions—Verizon is projecting a $1.5 billion to $2 billion drop in 2025 cash taxes, while Lumen claimed a $400 million refund and Diamondback anticipates $300 million in annual savings. These changes, highlighted in recent securities filings, are designed to boost investment and strengthen corporate balance sheets, according to statements from industry executives. However, the law also comes partly at the expense of renewable-energy companies and Medicaid spending, raising questions about broader economic impacts and job creation.

The tax legislation, signed on July 4, introduces immediate, full deductions for many capital expenditures and research costs, reversing limits set by earlier laws and making these perks permanent under GOP leadership. Republican lawmakers, supported by business lobbyists, ensured provisions like bonus depreciation and expanded interest deductions were included, offering a “double win” by also blocking proposed tax increases. The Joint Committee on Taxation estimates these research and depreciation policies will reduce federal revenues by hundreds of billions through 2034, front-loading benefits to 2025 and 2026. While the law provides flexibility and immediate liquidity for companies, complications remain—firms must navigate new minimum taxes, limitations on international deductions, and warnings from figures such as consulting leader Kevin Jacobs and Senator Elizabeth Warren about potential long-term consequences and lost government revenue.

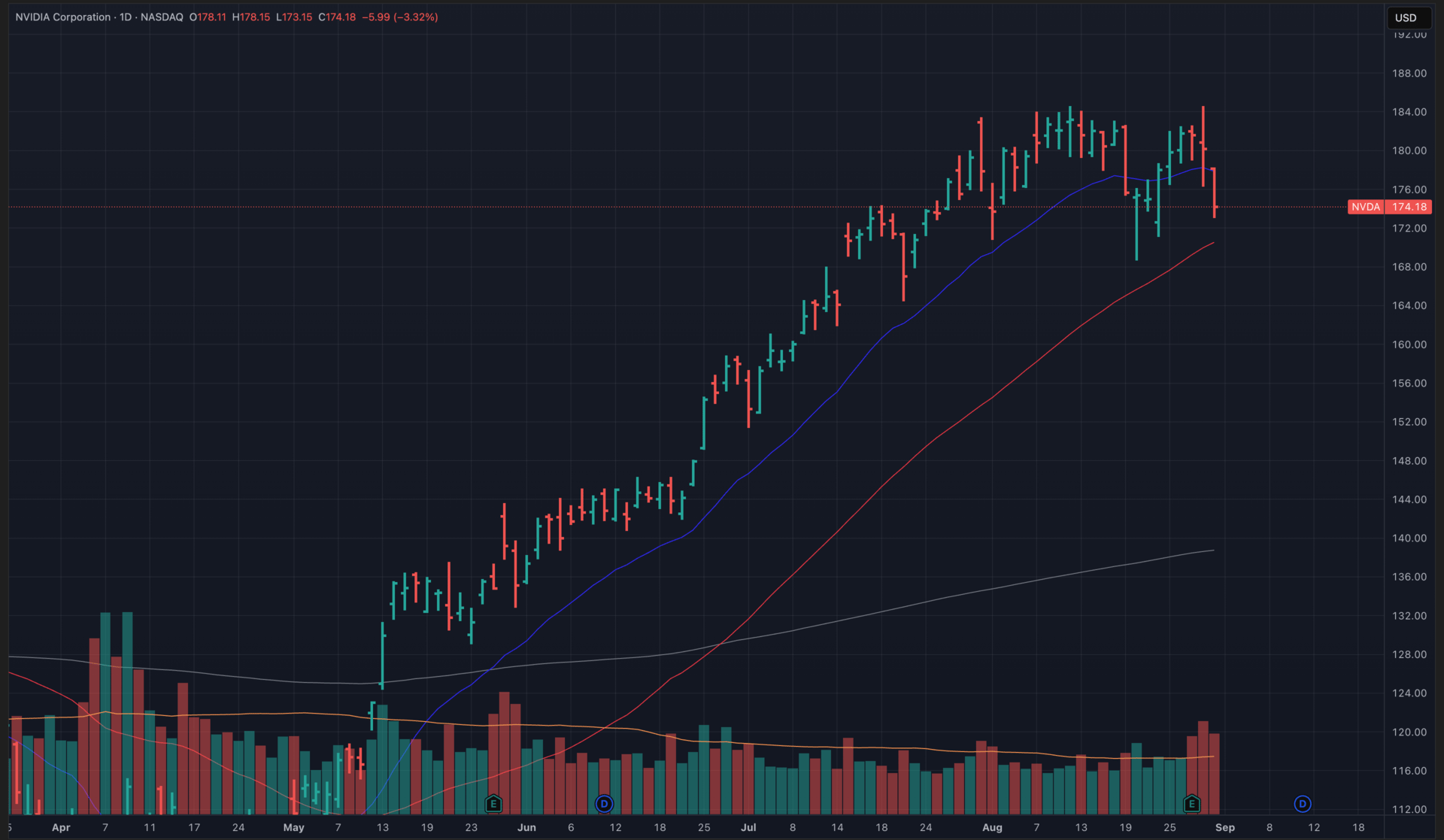

Editor’s Chart of the Day

This chart puts the spotlight on NVIDIA Corporation (NVDA), a leading force in advanced graphics, data center computing, and the backbone of today’s Artificial Intelligence revolution.

Benefiting from powerful industry tailwinds, NVDA has consistently ranked among the market’s top-performing names in recent years. After surging to retest its August highs, shares pulled back to the 50-day moving average, mirroring broader consolidation in mega-cap tech. Its post-earnings reaction proved underwhelming: despite posting strong fundamentals, NVDA quickly surrendered its momentum, underscoring fragile sentiment. The $184 resistance zone has repeatedly capped rallies, with visible institutional selling keeping a lid on further advances — a sign that downside risk could be brewing even as tech benchmarks hold firm. Nonetheless, NVDA’s one-year returns still land it in the market’s upper echelon, logging results that outshine 82% of U.S. stocks, which is quite a notable feat in today’s booming landscape.

Looking ahead, management confidently forecasts a robust 58.3% revenue jump for fiscal 2026, alongside a projected 49.2% surge in earnings, highlighting ongoing execution in the AI-dominated era. Should tech stocks find renewed strength, NVIDIA stands out as a compelling, high-momentum contender.

Major Earnings

CAVA Group, Inc. (CAVA) – September 2, After Market Close

Financial Trends: Annual revenue estimates of $1.18 billion for 2025 reflect steady growth despite recent slowdowns, with analysts maintaining a consensus EPS target of $0.56.

Strategic Initiatives: The company is aggressively expanding with 64-68 new restaurants planned for 2025, targeting underserved markets like California and Texas to reach 1,000 locations by 2032.

Key Metrics: Investors will focus on same-restaurant sales growth (recently revised down to 4.0%-6.0%), average unit volumes of $2.9 million, and restaurant-level margins around 25%.

Progress: CAVA has successfully opened 398 locations to date with robust digital sales comprising 38% of revenue and a loyalty program exceeding 8 million members.

Focus Areas: Management guidance on same-store sales recovery, margin sustainability amid cost pressures, and execution of expansion plans in new geographic markets will be critical.

Risks Potential: Rising labor costs, supply chain disruptions, market saturation in fast-casual dining, and potential macroeconomic headwinds affecting consumer discretionary spending remain key concerns.

Concerns: The significant reduction in same-store sales guidance from 6.0%-8.0% to 4.0%-6.0% has raised questions about traffic weakness and pricing power.

Market Trends: The Mediterranean fast-casual segment continues benefiting from health-conscious consumer trends, though broader restaurant industry faces challenges from inflation and shifting consumer spending patterns.

Broadcom Inc. (AVGO) – September 4, After Market Close

Financial Trends: Annual revenue estimates approach $64.2 billion for 2025 with projected EPS growth of 445% to $6.72, driven primarily by AI semiconductor demand and VMware integration.

Strategic Initiatives: The company is accelerating AI infrastructure development through custom XPUs for hyperscalers, enhanced VMware Cloud Foundation capabilities, and strategic partnerships with NVIDIA for next-generation data centers.

Key Metrics: Investors will monitor AI-related revenue growth (targeting $5.1 billion in Q3), VMware software recurring revenue, and semiconductor segment performance across networking and custom ASICs.

Progress: AI revenue surged 46% to $4.4 billion in Q2 2025, with the company securing long-term contracts with Meta, Microsoft, and other hyperscalers while maintaining 70% market share in Ethernet switches.

Focus Areas: Watch for updates on AI infrastructure capacity expansion, VMware subscription model transition progress, and guidance for accelerating cloud infrastructure demand.

Risks Potential: Geopolitical tensions affecting China operations, customer concentration risks from dependency on major hyperscalers, and potential regulatory challenges in AI technology deployment.

Concerns: High valuation metrics with P/E ratios exceeding 100x, alongside execution risks from the complex VMware integration and maintaining AI momentum amid intensifying competition.

Market Trends: The AI infrastructure boom continues driving demand for networking solutions and custom chips, while multicloud adoption accelerates enterprise demand for VMware's hybrid cloud offerings.

Oracle Corporation (ORCL) – September 8, After Market Close

Financial Trends: Annual revenue estimates project growth to approximately $67 billion for fiscal 2026, with EPS expectations of $5.44 reflecting strong cloud infrastructure momentum.

Strategic Initiatives: Oracle is investing heavily in AI and cloud infrastructure through its $30 billion OpenAI Stargate partnership, expanding OCI data centers globally, and enhancing multicloud database services across AWS, Azure, and Google Cloud.

Key Metrics: Investors will track OCI revenue growth (targeting 70%+ in fiscal 2026), remaining performance obligations (RPO) growth from $138 billion, and multicloud database adoption metrics.

Progress: Cloud infrastructure revenue surged 52% to $3 billion in Q4 2025, with total cloud revenue reaching $6.7 billion and RPO growing 41% year-over-year.

Focus Areas: Management will likely emphasize AI infrastructure scaling, sovereign cloud deployments, database modernization progress, and capacity expansion to meet surging demand.

Risks Potential: Infrastructure scaling constraints limiting revenue growth, intense competition from AWS and Microsoft Azure, and execution challenges from the recent 7% workforce reduction in cloud operations.

Concerns: Premium valuation at 35x P/E ratio amid capacity constraints that force customer requests into future quarters, plus integration risks from organizational restructuring.

Market Trends: Enterprise AI adoption drives massive demand for cloud infrastructure and database services, while regulatory requirements fuel growth in sovereign cloud solutions and data residency compliance offerings.

Meet Evan Buenger

Evan Buenger, Editor of the Bull and Bear Brief

From a young age, Evan was fascinated by the stock market. At just 11 years old, he received a Wall Street Journal subscription for his birthday, sparking a lifelong passion for investing. Evan spent his formative years studying the strategies and philosophies of legendary investors like Paul Tudor Jones, Stanley Druckenmiller, and George Soros, absorbing their wisdom and developing his own unique approach to the markets.

As Evan's knowledge grew, he began to incorporate the time-tested, technically-based strategies of trading legends like William O'Neil and Richard Wyckoff into his own investment framework. By borrowing elements from each and rigorously testing them in real-time, Evan created a powerful conglomerate strategy that encompasses fundamentals, technicals, and macroeconomics.

Today, Evan is a professional trader and was a top contender in the 2020 US Investing Championship. His extraordinary performance, with a 141.8% return, is a testament to his studious background, well-informed approach, and unwavering dedication to his craft.

At the core of Evan's strategy is identifying stocks that benefit from sector trends and rotation. By combining fundamental analysis with a focus on relative strength and advanced technical analysis techniques, Evan is able to identify the stocks that are most likely to move higher or lower over the intermediate term.

While he keeps a close eye on macroeconomic trends, his willingness to adapt to changing market conditions, as well as his developed ability to know when to and not to act in a fast-moving market, is what sets him apart. Evan has consistently demonstrated his ability to navigate even the most challenging investment environments. His impressive track record and unique perspective make him a valuable voice in the world of finance, and he is thrilled to have the opportunity to share his insights and expertise with subscribers of the Bull and Bear Brief.

Subscribe to Stock Portfolio Recommendations Newsletter to read the rest.

Become a paying subscriber of the Bull and Bear Brief: Stock Portfolio Recommendations Newsletter to get access to this post and other subscriber-only content.

Upgrade to Stock Portfolio Recommendations NewsletterA subscription gets you:

- Expert-curated stock trades delivered weekly to strategically build your wealth-generating portfolio

- Real-time position management with timely alerts on existing holdings—ensuring you capture profits and minimize losses with precision timing

- Monthly Q&A where we address paid subscriber questions, examine real-world scenarios, and discuss current market conditions

- Regular reviews of both successful and unsuccessful trade recommendations, analyzing what worked, what didn't, and the lessons we can extract