Market’s Week in Review

September 29-October 3, 2025

Short-Term ETF Price Targets

ETF | Short-Term Target |

|---|---|

SPY | $654 |

QQQ | $588 |

Week’s Market Performance

Index | Current Level | Percent Change: Week | Percent Change: Year-to-Date |

|---|---|---|---|

S&P 500 | 6,715.79 | +0.82% | +14.18% |

NASDAQ 100 | 24,785.52 | +0.71% | +17.96% |

VIX | 16.61 | +3.04% | -4.10% |

10-Year Treasury Yield | 4.15% | -0.56% | -9.40% |

Gold | $3,885.60 | +1.37% | +48.06% |

Oil | $60.71 | -4.32% | -15.44% |

Market News

OPEC+ Opts for Cautious Output Hike to Reclaim Market Share Amid Softer Prices

Eight OPEC+ producers led by Saudi Arabia will raise crude output by 137,000 barrels a day in November, matching October’s increase, after an online meeting Sunday, aiming to claw back market share from U.S. shale, Brazil and Guyana without triggering a price slump. The move extends the bloc’s gradual unwinding of earlier quotas, after a 2.2 million-barrel-a-day cut was fully rolled back in September and a separate 1.65 million-barrel-a-day layer is being eased. Oil benchmarks Brent and West Texas Intermediate are down more than 13% this year amid concerns about a supply glut, with prices trading in a $65–$70 range over the past three months. Analysts say strong summer demand, Chinese stockpiling, and ongoing conflicts in the Middle East and Ukraine have helped establish a floor under prices even as supply grows.

Traders had positioned for a bigger increase, pushing Brent down $4.90 last week, but the measured step signals the cartel’s caution as it balances revenue goals with market stability, according to Rystad Energy’s Jorge León, a former OPEC official, who warned “the real test will come when fundamentals and politics shift again”. JPMorgan forecasts a surplus of about 2 million barrels a day through year-end and into 2026, while the IEA now expects global oil supply growth of 2.7 million barrels a day this year and 2.1 million next year. OPEC, which pumps up to 40% of the world’s oil, began curtailing production in 2023 to stabilize prices, a decision criticized by Washington for indirectly supporting Russia; the group shifted course in April by rolling back voluntary cuts. The eight producers behind those cuts—Saudi Arabia, Russia, Iraq, the U.A.E., Kuwait, Kazakhstan, Algeria and Oman—are scheduled to meet again on Nov. 2.

Huawei AI Chips Found Using TSMC Dies, Samsung and SK Hynix Memory Despite US Curbs

Huawei’s Ascend 910C AI accelerators contain advanced components from Taiwan Semiconductor Manufacturing Co., Samsung Electronics, and SK Hynix, according to teardowns by TechInsights that underscore China’s ongoing reliance on foreign hardware for cutting-edge semiconductors. The Ottawa-based firm found TSMC-made logic dies and HBM2E memory from Samsung and SK Hynix in multiple samples of the 910C, which began mass shipments earlier this year as Huawei’s leading domestic alternative to Nvidia. The findings come amid US export restrictions targeting AI processors and high-bandwidth memory, and after TSMC said it halted shipments tied to Huawei in 2020 and cut off intermediary Sophgo, which had procured millions of dies later linked to Huawei. Huawei did not respond to a request for comment during China’s weeklong holiday, while the report highlights Beijing’s efforts to scale domestic chip output as Washington seeks to limit access to frontier AI systems.

SemiAnalysis estimates Huawei stockpiled about 2.9 million TSMC-produced dies via Sophgo and predicts the company will remain constrained by HBM supplies as inventories dwindle by year-end, despite progress by China’s CXMT. SK Hynix and Samsung said they comply with US export regulations and ceased transactions with Huawei following restrictions imposed in 2020, though TechInsights could not determine when or how Huawei acquired the HBM2E parts found in the teardowns. TSMC said the 910C units examined appeared to use dies analyzed in October 2024 and not newer tech, reaffirming compliance with export controls and noting shipments and manufacturing for that chip have been halted since then. The episode illustrates the complexity of AI chip supply chains and the strategic importance of HBM, where SK Hynix remains a leader alongside Micron and Samsung, with components often designed for specific accelerators.

Costco Adds Ozempic and Wegovy to Pharmacy Shelves at Flat $499 Monthly Price

Novo Nordisk will begin selling its prescription-only weight-loss drugs Ozempic and Wegovy at more than 500 Costco pharmacies across the United States, expanding a discounted $499-per-month, out-of-pocket price already available at CVS, Walmart, and the company’s own website. The move, announced Friday, comes as the Danish drugmaker seeks to defend market share amid cheaper copycat rivals and uneven insurance coverage that leaves many patients paying cash. Costco members with prescriptions will pay $499 for a four-week supply, roughly half Ozempic’s list price and about two-thirds less than Wegovy’s, with additional 2 percent rewards for Executive members and Costco Citibank Visa cardholders; insured prices will vary by plan. “We continue to find new ways to make access to our medicines more convenient, meeting people where they are,” a Novo Nordisk spokeswoman said.

The expansion follows intensifying competition: Eli Lilly in February offered its Zepbound vials at $499 per month or less, while Novo Nordisk in March cut Wegovy’s cash price to $499 for certain patients. Costco’s reach—over 100 million visitors and status as the world’s third-largest retailer by revenue—could add significant volume as many health plans still deny coverage for GLP-1 drugs. Semaglutide, the active ingredient in Ozempic and Wegovy, mimics the GLP-1 hormone to slow digestion and increase satiety; a four-year study found average sustained weight loss of around 10 percent for participants. Despite reporting $24 billion in sales in the first half of 2025, Novo Nordisk has warned of slowing growth, replaced its CEO in May, and announced 9,000 job cuts last month, while its share price has fallen more than 50 percent this year.

AI Video App Sora 2 Sparks Viral Craze and Legal Scrutiny Over Copyrighted Characters

OpenAI’s new Sora 2 app shot to the top of Apple’s Photo and Video charts within a day of launch, fueling a wave of hyper-realistic AI videos featuring both user “cameos” and famous characters such as Mario, Pikachu, and Lara Croft. Powered by an upgraded media-generation model, Sora 2 creates high-definition video with matching dialogue and sound effects from simple prompts, raising immediate concerns among copyright and deepfake experts. The Wall Street Journal reported the app would allow copyrighted material in outputs unless rights holders opt out, a process that appears to require submitting examples rather than blanket exclusions. UCLA law professor Mark McKenna said such an approach is unlikely to align with copyright law, noting a key distinction between training on copyrighted data and outputting protected content.

The app’s viral debut also highlighted broader risks, including potential deepfakes and harmful content, with one widely shared clip depicting CEO Sam Altman shoplifting—underscoring how easily the tool can fabricate crimes involving real people. OpenAI says Sora 2 includes visible moving watermarks and invisible metadata to signal AI origins, though its own documentation acknowledges metadata is easily stripped on social platforms; experts caution multiple verification layers are needed and their effectiveness remains unproven. The company, which has not detailed its training data, faces ongoing copyright lawsuits alongside industry scrutiny, as rivals like ByteDance’s Seedance face similar questions. While the app is publicly downloadable, access to Sora’s services remains invitation-only as OpenAI scales availability, and major studios declined comment amid early rights-holder pushback.

Economic Headwinds, Not AI, Drive Most Layoffs, New Analyses Find

Hiring weakness in 2025 stems primarily from broader economic conditions and organizational restructuring rather than automation, according to new research and layoff data cited by Axios. A Yale Budget Lab report found no discernible disruption to the overall labor market’s “occupational mix” in the 33 months since ChatGPT’s launch, a pattern resembling past tech waves like the PC and early internet eras. Challenger, Gray & Christmas reported 20,219 job cuts attributed to “automation and possibly AI” through September, with only 17,375 explicitly linked to AI—far below cuts tied to economic conditions (208,227) and “DOGE actions” (293,753) over the same period. Federal Reserve Chair Jerome Powell said he sees “great uncertainty” that AI is depressing labor demand, adding that slowing job creation reflects a cooling economy more than technology-driven displacement.

Experts say current AI tools are more likely to complement workers than replace them in the near term, despite model benchmarks approaching human-level performance on many tasks. OpenAI’s chief economist Ronnie Chatterji told Axios productivity gains are expected to come alongside human judgment, not as a wholesale substitute. Still, leaders warn of longer-term risks if entry-level roles are squeezed, limiting pathways to advance skills in an AI-augmented workplace; Stanford’s Jure Leskovec cautioned, “You cannot supervise an intern if you are less skilled than the intern”. Axios notes CEOs report moderating hiring plans at the “dawn of AI,” but the immediate labor picture remains one of incremental change, not systemic upheaval.

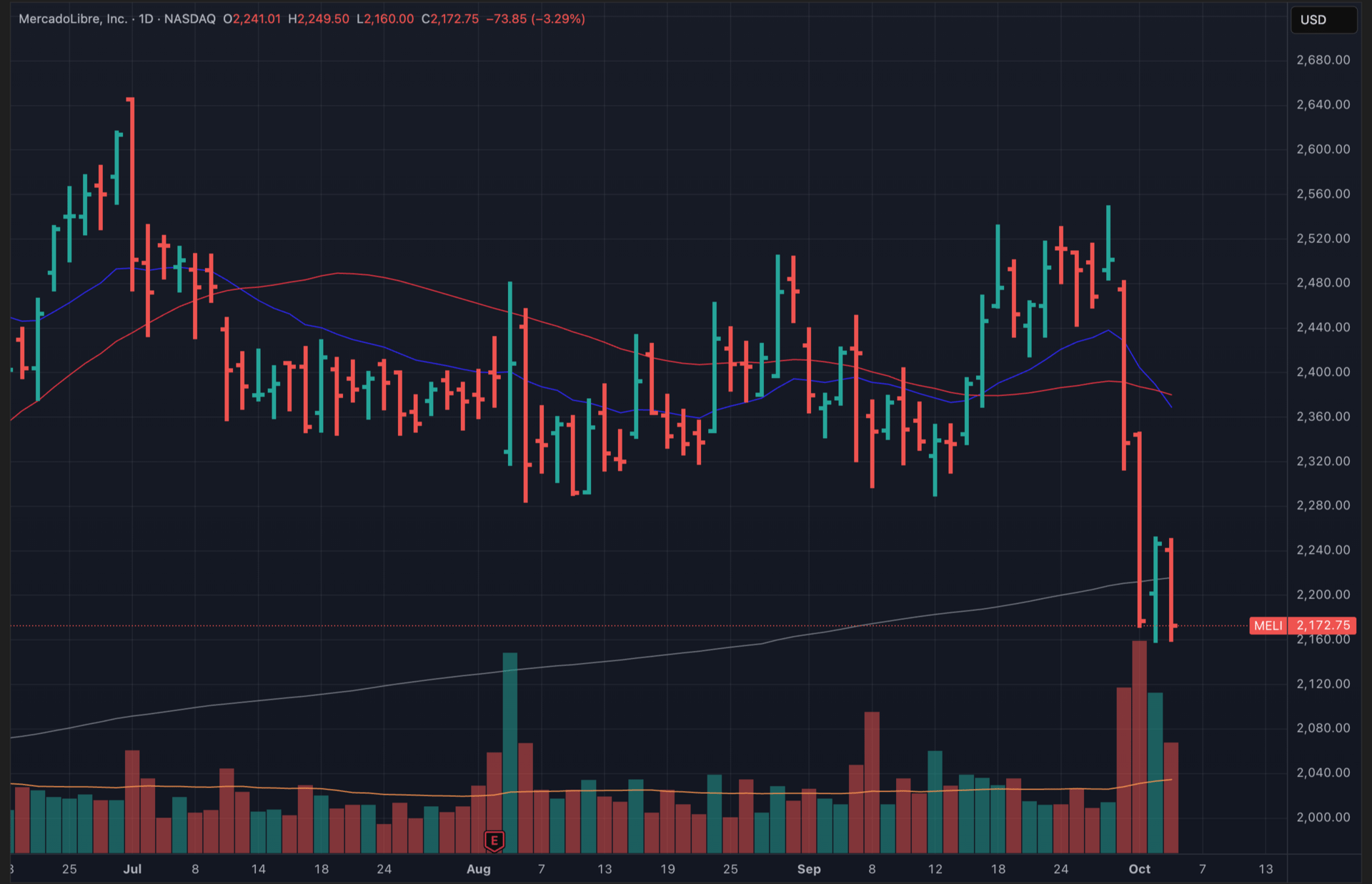

Editor’s Chart of the Day

Spotlighting MercadoLibre, Inc. (MELI) — Latin America’s leading commerce and fintech platform, MELI operates an end-to-end digital ecosystem spanning online marketplaces, payments (Mercado Pago), logistics (Mercado Envios), credit, and advertising. Its flywheel monetizes high-frequency consumer and merchant activity across multiple profit pools, reinforcing network effects and improving unit economics as scale increases.

After holding support near $2,300 through much of the summer, MELI ripped higher and then retraced quickly back toward its 200-day moving average, cutting through the 20-day and 50-day moving averages with little resistance — a textbook footprint of heavy institutional selling. The $2,150–$2,250 area around the 200-day now marks the near-term battleground, a likely liquidity magnet where order flow concentrates as consumer discretionary leadership cools into year-end. Sustained closes above this zone keep the likely probability of a continued uptrend intact, whereas a decisive break below the 200-day raises the risk of a deeper selloff as the stock trades more with its sector than its fundamentals.

Even so, MELI’s trailing 12-month return still outpaces roughly half the U.S. market — no small feat in a tape dominated by AI and semis soaking up flows with headline growth and powerful narratives. Execution remains strong: MELI continues to compound GMV, payments volume, and credit penetration while expanding take rates and improving operating leverage, supporting its case despite cyclical or sector headwinds. Management’s outlook of roughly 26.5% revenue growth and 51.7% earnings growth for 2026 underscores disciplined scaling and resilient unit economics despite factors outside management’s control.

If consumer discretionary stocks weakens further from here, price action likely favors chop over either an upward or downward trend: strong fundamentals, held back by a weak sector. But fundamentally, MELI’s multi-rail monetization, category leadership, and durable competitive advantages make it a high-quality compounder to buy on weakness. Long-term investors can stay patient, holding for either a cleaner technical setup or the next fundamental catalyst to reassert its market leadership.

Major Earnings

Exxon Mobil Corporation (XOM) – October 6, After Market Close

Financial Trends: ExxonMobil projects fiscal 2025 annual EPS of approximately $6.34 with 2026 estimated at $7.15, supported by record upstream production and strategic project completions.

Strategic Initiatives: The company approved $6.8 billion investment in Guyana's Hammerhead project targeting 150,000 barrels per day by 2029, while pursuing $30 billion in low-carbon solutions through 2030 focused on carbon capture and hydrogen.

Key Metrics: Investors will focus on upstream production volumes especially from Permian Basin and Guyana operations, refining margins amid global supply pressures, and progress toward 2030 production targets of 2.3 million barrels per day.

Progress: Q2 2025 achieved highest second-quarter production since Exxon-Mobil merger over 25 years ago, with Permian Basin producing record 1.6 million oil equivalent barrels per day and ten major project start-ups expected in 2025.

Focus Areas: Management will update on 2025 project start-ups expected to drive over $3 billion in 2026 earnings, progress on $30 billion low-carbon investment plan, and capital allocation between growth projects and shareholder returns.

Risks Potential: Global fuel oversupply pressuring refining margins, geopolitical tensions affecting international operations, and commodity price volatility with oil forecasts suggesting Brent declining toward $56 by late 2026.

Concerns: Q3 2025 earnings estimates of $1.51 represent a 21% year-over-year decline from $1.92 in Q3 2024, while revenue expectations show continued pressure from lower crude prices.

Market Trends: Energy transition demands balanced with traditional hydrocarbon strength as global oil demand projected to reach 105 million barrels per day by 2050, while regulatory support for carbon capture creates investment tailwinds.

Delta Air Lines, Inc. (DAL) – October 9, After Market Close

Financial Trends: Delta projects fiscal 2025 annual EPS between $5.25-$6.25 with free cash flow of $3-4 billion, representing over 10% growth year-over-year compared to 2024 results.

Strategic Initiatives: The airline's 2025 fleet modernization includes 42 new aircraft deliveries featuring A321neos and A350s offering 20-25% fuel efficiency improvements while retiring 30 older, less efficient aircraft.

Key Metrics: Investors will track unit revenue trends expected to improve gradually, operating margins guided at 9-11% for Q3, and progress toward mid-teens operating margin targets through 2027.

Progress: Q2 2025 delivered record revenue of $15.51 billion with $2.10 EPS beating estimates, while maintaining industry-leading operational performance and 13% operating margins.

Focus Areas: Management will address Q3 revenue guidance of flat to up 4% year-over-year, capacity management in slower-growth environment, and sustainable aviation fuel procurement toward 10% replacement by 2030.

Risks Potential: Broader economic uncertainty around global trade affecting demand, inflationary pressures on operating costs, and competitive pricing pressure in domestic markets.

Concerns: Q3 2025 EPS consensus of $1.48 represents modest growth expectations while revenue guidance suggests continued demand normalization following post-pandemic recovery peaks.

Market Trends: Premium travel demand remains resilient supporting revenue mix optimization, while industry capacity discipline and sustainable aviation fuel adoption drive long-term competitive positioning.

Fastenal Company (FAST) – October 13, After Market Close

Financial Trends: Fastenal forecasts 2025 annual revenue growth in mid-single digits with EPS projected at $1.15-1.20, supported by contract customer expansion and digital sales penetration reaching 62% of total sales.

Strategic Initiatives: The company targets 25,000-26,000 weighted FASTBin/FASTVend device signings for 2025 while pursuing $10 billion total revenue goal through expanded onsite locations and digital footprint growth.

Key Metrics: Investors will monitor digital footprint penetration approaching 64% of sales, contract customer growth driving 73% of revenue, and operating margin sustainability above 21% levels.

Progress: Q2 2025 achieved first-ever quarterly sales exceeding $2 billion with 8.6% revenue growth to $2.08 billion, while adding 6,458 new FASTBin/Vend devices and expanding to 1,986 onsite locations.

Focus Areas: Management will discuss progress toward $250-270 million capital expenditure plan for 2025, pricing actions to offset tariff pressures, and technology investments supporting revenue growth acceleration.

Risks Potential: Trade policy uncertainty creating customer caution, tariff-related cost pressures on imported products, and manufacturing sector headwinds affecting end-market demand.

Concerns: Q3 2025 EPS estimate of $0.30 represents modest 15% growth from prior year $0.26, while revenue growth expectations suggest continued macro pressures on industrial customers.

Market Trends: Industrial distribution market consolidation favoring scale players with technology capabilities, while manufacturing automation trends support vending solutions adoption and inventory management digitization.

Meet Evan Buenger

Evan Buenger, Editor of the Bull and Bear Brief

From a young age, Evan was fascinated by the stock market. At just 11 years old, he received a Wall Street Journal subscription for his birthday, sparking a lifelong passion for investing. Evan spent his formative years studying the strategies and philosophies of legendary investors like Paul Tudor Jones, Stanley Druckenmiller, and George Soros, absorbing their wisdom and developing his own unique approach to the markets.

As Evan's knowledge grew, he began to incorporate the time-tested, technically-based strategies of trading legends like William O'Neil and Richard Wyckoff into his own investment framework. By borrowing elements from each and rigorously testing them in real-time, Evan created a powerful conglomerate strategy that encompasses fundamentals, technicals, and macroeconomics.

Today, Evan is a professional trader and was a top contender in the 2020 US Investing Championship. His extraordinary performance, with a 141.8% return, is a testament to his studious background, well-informed approach, and unwavering dedication to his craft.

At the core of Evan's strategy is identifying stocks that benefit from sector trends and rotation. By combining fundamental analysis with a focus on relative strength and advanced technical analysis techniques, Evan is able to identify the stocks that are most likely to move higher or lower over the intermediate term.

While he keeps a close eye on macroeconomic trends, his willingness to adapt to changing market conditions, as well as his developed ability to know when to and not to act in a fast-moving market, is what sets him apart. Evan has consistently demonstrated his ability to navigate even the most challenging investment environments. His impressive track record and unique perspective make him a valuable voice in the world of finance, and he is thrilled to have the opportunity to share his insights and expertise with subscribers of the Bull and Bear Brief.

Subscribe to Stock Portfolio Recommendations Newsletter to read the rest.

Become a paying subscriber of the Bull and Bear Brief: Stock Portfolio Recommendations Newsletter to get access to this post and other subscriber-only content.

Upgrade to Stock Portfolio Recommendations NewsletterA subscription gets you:

- Expert-curated stock trades delivered weekly to strategically build your wealth-generating portfolio

- Real-time position management with timely alerts on existing holdings—ensuring you capture profits and minimize losses with precision timing

- Monthly Q&A where we address paid subscriber questions, examine real-world scenarios, and discuss current market conditions

- Regular reviews of both successful and unsuccessful trade recommendations, analyzing what worked, what didn't, and the lessons we can extract