Market’s Week in Review

November 3-November 7, 2025

Short-Term ETF Price Targets

ETF | Short-Term Target |

|---|---|

SPY | $674 |

QQQ | $613 |

Week’s Market Performance

Index | Current Level | Percent Change: Week | Percent Change: Year-to-Date |

|---|---|---|---|

S&P 500 | 6,728.80 | -1.80% | +14.40% |

NASDAQ 100 | 25,059.81 | -3.52% | +19.26% |

VIX | 19.16 | +11.59% | +10.62% |

10-Year Treasury Yield | 4.132% | -0.22% | -9.75% |

Gold | $4,000.98 | -0.04% | +52.45% |

Oil | $59.83 | -2.00% | -16.66% |

Market News

Thanksgiving Air Travel Faces Major Disruptions as Federal Shutdown Deepens

U.S. airlines canceled over 2,100 flights on Sunday, marking the highest daily total since the federal government shutdown triggered nationwide air traffic cutbacks. Transportation Secretary Sean Duffy warned that if the shutdown continues into the Thanksgiving season, air travel may “slow to a trickle” across the country. With flight delays affecting 40 of the busiest airports and over 7,000 delays reported on Sunday alone, major hubs like Atlanta’s Hartsfield-Jackson and Newark Liberty International faced hundreds of cancellations. The Federal Aviation Administration (FAA) began its flight reduction protocols on Friday, expecting cuts to intensify to 10% by November 14, as air traffic controllers, unpaid for nearly a month, increasingly stay away from work.

The cascading effects of the shutdown extend beyond traveler inconvenience, with staffing shortages leading to longer delays—up to 75 minutes at New York airports—and some controllers fast-tracking retirement, according to Secretary Duffy. He stated that air travel could slow further if the shutdown persists, potentially reaching a 20% reduction. Trade groups note that controller shortages accounted for the majority of recent delay hours; since October 1, more than 4 million U.S. passengers have been affected. Duffy dismissed allegations of political motives behind the FAA's actions, emphasizing safety concerns amid an overstressed system: “I needed to take action to keep people safe,” he said, underscoring the growing disruptions Americans may face unless the shutdown ends and controllers are paid again.

Trump Floats 50-Year Mortgage Proposal Amid Debate on Housing Affordability and Risk

President Donald Trump’s recent suggestion of introducing 50-year mortgages has sparked widespread discussion in Washington and among housing experts. Federal Housing Finance Agency director Bill Pulte supported the move, calling it a “game changer,” while other conservatives, including Rep. Marjorie Taylor Greene, voiced strong opposition, arguing that such loans would primarily benefit banks and lenders and saddle homeowners with high lifetime interest payments. Critics pointed out that existing regulations, enacted after the 2008 financial crisis, cap most mortgage terms at 30 years. Housing analysts, such as Professor Richard Green of the University of Southern California, acknowledged potential reductions in monthly payments, but warned of higher overall interest costs with longer loan terms.

Further scrutiny reveals that 50-year mortgages could undermine the buildup of home equity, increasing vulnerability to negative equity and potential defaults, as evidenced during the subprime crisis. Research from institutions like Colorado State and Monmouth University found that homeowners “underwater” on their loans are 150% to 200% more likely to default. Experts agree that extending mortgage terms would not fix the fundamental issue of housing affordability in America, which stems from a severe shortage of new construction since the last housing crash. Until the supply of homes increases across all segments, the housing affordability crisis is expected to persist regardless of mortgage structure.

Tesla Shareholders Back $1 Trillion Musk Compensation, Ushering in Expansion and New Product Phase

Tesla shareholders have overwhelmingly approved a new pay package for CEO Elon Musk, which could be worth up to $1 trillion, marking a pivotal moment for the electric vehicle giant. The proposal passed with more than 75% support, prompting Musk to thank investors and describe the development as not just a new chapter, but “a whole new book” for Tesla. Following Thursday night’s vote, Tesla stock saw initial gains but declined in early Friday trading. Analyst Dan Ives of Wedbush noted that retaining Musk unlocks substantial AI-driven valuation for Tesla over the next several months. This new compensation plan comes as Musk’s previous 2018 package remains disputed in Delaware courts, with claims shareholders lacked adequate information.

Alongside the pay package approval, shareholders reelected directors Ira Ehrenpreis, Joe Gebbia, and Kathleen Wilson-Thompson, and granted preliminary approval for investment in Musk’s AI startup xAI, pending further board review due to abstentions. At the shareholder meeting, Musk announced that Tesla will build a million-unit Optimus robot production line in Fremont, California, and expand to a ten-million-unit line at Giga Texas in Austin. He also revealed plans for Cybercab robotaxi trials in multiple cities including Miami, Dallas, Phoenix, and Las Vegas, with production slated for April 2026. Additionally, Tesla will unveil its new Roadster model on April 1, 2026, with production set to follow within 12 to 18 months.

Pfizer Secures $10 Billion Metsera Acquisition as Novo Nordisk Withdraws

Pfizer has finalized a $10 billion agreement to acquire Metsera, an obesity drug developer, following a competitive bidding war that saw Danish rival Novo Nordisk exit the race due to U.S. antitrust concerns. Metsera accepted Pfizer’s revised offer late Friday, citing legal and regulatory risks with Novo’s bid, including warnings from the Federal Trade Commission. The deal grants Pfizer premium access to the fast-growing obesity drug market, a sector previously dominated by Novo Nordisk and currently led by U.S. competitor Eli Lilly. The transaction involves $86.25 per share in cash—split between a direct payment and contingent value rights for additional compensation—with Metsera’s board recommending shareholder approval at a meeting scheduled for November 13.

Novo Nordisk, after declaring its “maximum value” bid and encountering regulatory obstacles, announced it would not increase its offer and would focus on advancing its own pipeline of obesity treatments. Industry analysts described the recent contest as “Game of Thrones-level,” referencing its intensity and importance for future market share. The bidding process surged Metsera’s valuation by nearly 60% this past week, reflecting optimism around its experimental drugs MET-097i and MET-233i, which analysts estimate could achieve $5 billion in combined peak sales. While Metsera’s treatments remain years from commercialization, Pfizer’s acquisition signals its commitment to regaining a foothold in the lucrative obesity therapeutics sector, with some analysts warning the $10 billion price tag rests on ambitious revenue projections and evolving market conditions.

U.S. Sees Dramatic Spike in October Layoffs Driven by Tech, Retail, and AI Cost-Cutting

In October, U.S. employers cut over 150,000 jobs, marking the largest wave of layoffs in more than two decades, according to outplacement firm Challenger, Gray & Christmas. Technology companies led the surge, followed by retail and services, as firms like Amazon, UPS, and Microsoft announced substantial workforce reductions amid cost-cutting measures and increased adoption of artificial intelligence. Layoffs for the month climbed 175% from the previous year, bringing the total for 2025 to over 1 million—a 65% increase compared to last year. “Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes,” said Andy Challenger, chief revenue officer at Challenger, Gray & Christmas.

The Challenger report also noted more than 450 corporate job cut announcements in October, the highest since March, defying the usual fourth-quarter reluctance to announce layoffs. The impact was compounded by the so-called “DOGE Impact”—significant reductions among federal workers and contractors from loss of government funding. Federal Reserve officials, amid broader economic uncertainty, have responded by lowering interest rates twice since September, currently ranging from 3.75% to 4%. Some economists caution another rate reduction may follow, though the official outlook remains uncertain. Labor experts pointed out that persistent labor supply constraints could help offset unemployment impacts, despite the challenging hiring environment for those laid off in this latest round of cuts.

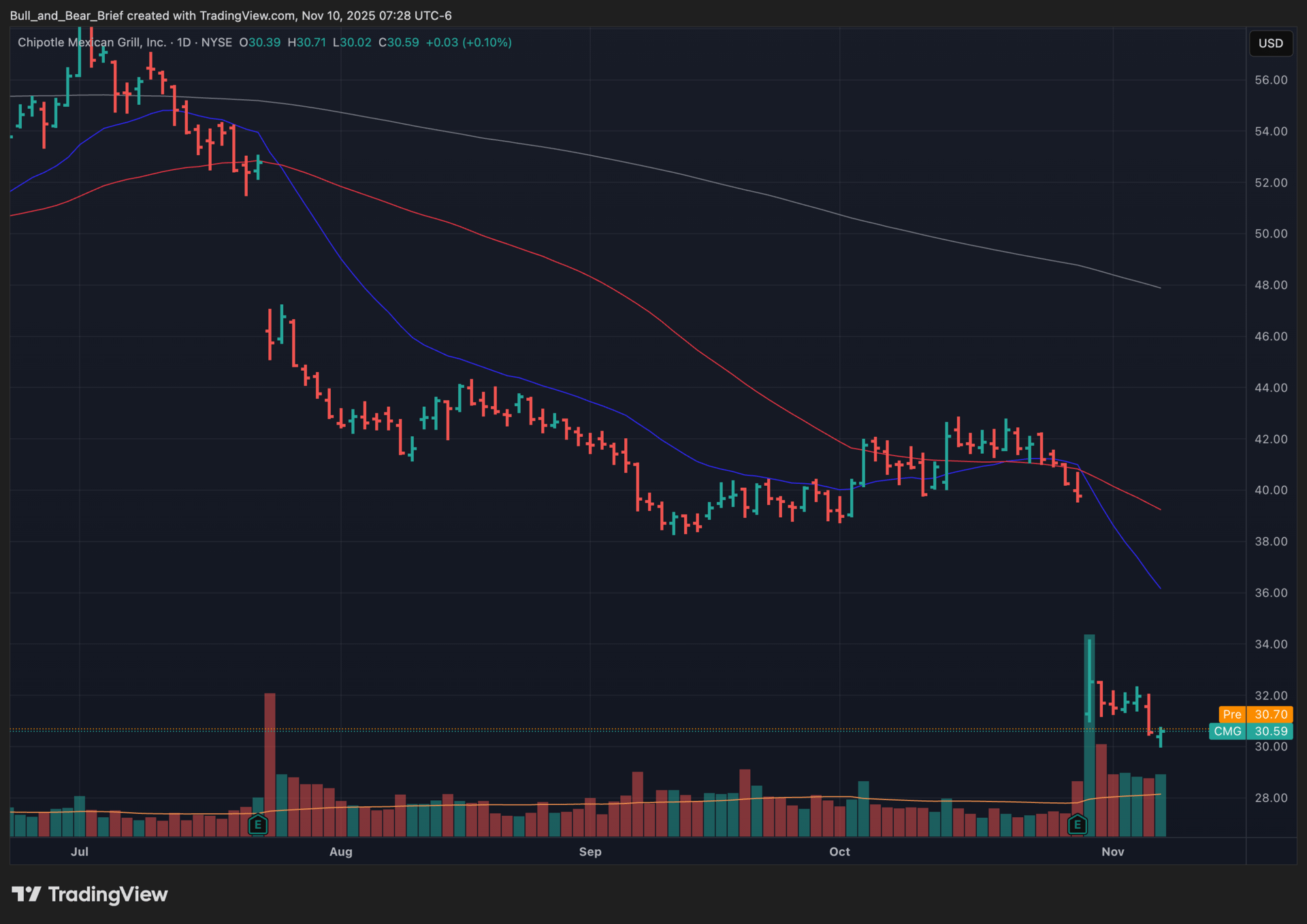

Editor’s Chart of the Day

Spotlighting Chipotle Mexican Grill (CMG) — A dominant force in fast-casual dining, digital innovation, and restaurant technology, Chipotle serves customizable burritos, bowls, tacos, salads, and sides with responsibly sourced ingredients, while building one of the industry's most valuable digital ecosystems with over 40 million Chipotle Rewards members, mobile ordering platforms, Chipotlanes (digital pickup drive-thrus), delivery partnerships, and expanding catering services. Its portfolio spans fresh food preparation, digital integration, and proprietary technology (Autocado avocado processing robots, Augmented Makeline, high-efficiency kitchen equipment) that together drive powerful recurring traffic, industry-defining loyalty program stickiness, and unmatched fast-casual brand strength.

After a challenging year marked by slowing comparable sales growth and transaction declines, CMG fell sharply below its 20-day and 50-day moving averages in October following disappointing Q3 results, showcasing vulnerability as fast-casual dining faces scrutiny over consumer spending pressure and value perception among younger, lower-income demographics. The stock recently pushed to new 52-week lows near $30 after management cut full-year guidance for the third consecutive quarter, and its sharp 25% monthly decline suggests the stock needs significant time to stabilize and rebuild technical support before moving higher. A continued break below key support levels or failure to reclaim moving averages would increase risk for prolonged weakness, with shares likely trading more with broader consumer discretionary sentiment than company fundamentals if macroeconomic conditions deteriorate further.

Chipotle's trailing 12-month returns have significantly underperformed the broader market and S&P 500, with CMG down over 40% while the S&P 500 gained 20%, despite historical sector leadership and strong brand positioning. Execution remains focused: Chipotle continues to convert robust restaurant traffic into high-engagement digital and loyalty-driven recurring visits, aggressively invests in menu innovation (limited-time proteins, new sauces like Red Chimichurri and Adobo Ranch), next-generation restaurant technology (Autocado, HEAP equipment package), and international expansion while maintaining disciplined new restaurant openings. Management's outlook points to a cautious near-term path with low-single-digit comparable sales declines expected for 2025, but targets mid-single-digit comp growth returning by 2026 driven by accelerated menu innovation, operational improvements, and 350-370 new restaurant openings including international expansion—even with persistent consumer headwinds and margin pressure from inflation and wage growth.

If consumer spending weakness and value perception challenges intensify across fast-casual dining, price action could lean toward continued downside or extended consolidation at depressed levels, but Chipotle's fundamentals are anchored by its massive 40 million-member loyalty base, extensive Chipotlane network (over 80% of new restaurants), explosive international growth into Asia (South Korea, Singapore in 2026), Mexico, and the Middle East, and relentless menu innovation and technology investments. Long-term investors can remain patient, watching for cleaner technical setups showing stabilization and reclaiming of moving averages combined with big catalysts—compelling new menu limited-time offers driving transaction growth, significant loyalty program engagement expansion, or accelerating international market penetration—to reassert fast-casual leadership.

Major Earnings

Occidental Petroleum (OXY) – November 10, After Market Close

Financial Trends: Occidental’s annual revenue is projected near $27 billion, with EPS declining ~50% YoY as oil price softness weighs on margins.

Strategic Initiatives: The company finalized a $9.7 billion OxyChem divestiture and remains committed to debt reduction and direct air capture (DAC) scaling.

Key Metrics: Investors will focus on annual free cash flow, oil and gas production volumes, unit costs, and net debt reduction.

Progress: OXY has cut $7.5 billion in debt, improved operating efficiency in Permian assets, and advanced commissioning of the Stratos DAC plant.

Focus Areas: Watch for updates on the Permian production ramp, capital discipline, Stratos project status, and FY 2026 cost guidance.

Risks Potential: Lower realized commodity prices, OPEC+ decisions, and capital intensity for DAC and low-carbon projects are key headwinds.

Concerns: EPS and revenue are tracking below prior-year levels; costs have ticked up and analyst estimates have seen downward revisions.

Market Trends: Weak crude pricing and rising capital costs have capped upside for US oil producers, but ongoing energy transition policies and M&A could be catalysts for re-rating.

Cisco Systems (CSCO) – November 12, After Market Close

Financial Trends: Cisco’s annual revenue is projected at $56.7 billion, with margins expanding and EPS currently tracking above $4, underpinned by record operating income.

Strategic Initiatives: Management continues to scale its AI-powered networking, cloud security, and software offerings, highlighted by the Splunk acquisition and new silicon launches.

Key Metrics: Watch for annualized recurring revenue, free cash flow, product order growth, and margin trajectory.

Progress: Cisco exceeded its 2025 AI infrastructure order targets, completed the Splunk deal, and achieved 100% circular design compliance in new products.

Focus Areas: Investors will focus on updates for campus switch refreshes, AI and security growth, capital allocation, and guidance for Q2 and FY 2026.

Risks Potential: Tariff volatility, intensifying tech competition, and uncertain government contract spending may pressure costs and segment growth.

Concerns: Order growth has decelerated, software uptake is slower than management targets, and margin improvement may slow if macro conditions deteriorate.

Market Trends: The ongoing networking refresh cycle, rapid enterprise AI adoption, and cybersecurity consolidation remain positive tailwinds for Cisco’s segment leadership.

Walt Disney Company (DIS) – November 13, Before Market Open

Financial Trends: Disney’s annual revenue is projected near $95 billion, with adjusted EPS expected to jump 16% year over year as streaming and parks offset media softness.

Strategic Initiatives: Management focuses on cost discipline, global park expansion, and driving streaming profitability, while prepping for standalone ESPN+ and content-focused growth.

Key Metrics: Investors are watching Disney+ and Hulu subscriber numbers, ARPU, experiences operating income, and free cash flow.

Progress: The company is achieving double-digit operating income growth in entertainment, 8% in experiences, and has cut $5.5 billion in expenses YTD.

Focus Areas: Expect detailed commentary on streaming progress, park attendance trends, cost cutting, and early 2026 guidance for EPS and subscriber growth.

Risks Potential: Weak theatrical releases, lingering cord-cutting, and competitive streaming landscape may impact momentum and margin.

Concerns: Uncertainty in media recovery, heavy pre-opening cruise expenses, and integration costs have dented expectations, with India JV driving equity losses.

Market Trends: Streaming profitability, travel sector strength, and brand-driven park demand continue to shape Disney’s resilience versus legacy media rivals.

Meet Evan Buenger

Evan Buenger, Editor of the Bull and Bear Brief

From a young age, Evan was fascinated by the stock market. At just 11 years old, he received a Wall Street Journal subscription for his birthday, sparking a lifelong passion for investing. Evan spent his formative years studying the strategies and philosophies of legendary investors like Paul Tudor Jones, Stanley Druckenmiller, and George Soros, absorbing their wisdom and developing his own unique approach to the markets.

As Evan's knowledge grew, he began to incorporate the time-tested, technically-based strategies of trading legends like William O'Neil and Richard Wyckoff into his own investment framework. By borrowing elements from each and rigorously testing them in real-time, Evan created a powerful conglomerate strategy that encompasses fundamentals, technicals, and macroeconomics.

Today, Evan is a professional trader and was a top contender in the 2020 US Investing Championship. His extraordinary performance, with a 141.8% return, is a testament to his studious background, well-informed approach, and unwavering dedication to his craft.

At the core of Evan's strategy is identifying stocks that benefit from sector trends and rotation. By combining fundamental analysis with a focus on relative strength and advanced technical analysis techniques, Evan is able to identify the stocks that are most likely to move higher or lower over the intermediate term.

While he keeps a close eye on macroeconomic trends, his willingness to adapt to changing market conditions, as well as his developed ability to know when to and not to act in a fast-moving market, is what sets him apart. Evan has consistently demonstrated his ability to navigate even the most challenging investment environments. His impressive track record and unique perspective make him a valuable voice in the world of finance, and he is thrilled to have the opportunity to share his insights and expertise with subscribers of the Bull and Bear Brief.

Subscribe to Stock Portfolio Recommendations Newsletter to read the rest.

Become a paying subscriber of the Bull and Bear Brief: Stock Portfolio Recommendations Newsletter to get access to this post and other subscriber-only content.

Upgrade to Stock Portfolio Recommendations NewsletterA subscription gets you:

- Expert-curated stock trades delivered weekly to strategically build your wealth-generating portfolio

- Real-time position management with timely alerts on existing holdings—ensuring you capture profits and minimize losses with precision timing

- Monthly Q&A where we address paid subscriber questions, examine real-world scenarios, and discuss current market conditions

- Regular reviews of both successful and unsuccessful trade recommendations, analyzing what worked, what didn't, and the lessons we can extract