Market’s Week in Review

September 1-September 5, 2025

Short-Term ETF Price Targets

ETF | Short-Term Target |

|---|---|

SPY | $633 |

QQQ | $559 |

Week’s Market Performance

Index | Current Level | Percent Change: Week | Percent Change: Year-to-Date |

|---|---|---|---|

S&P 500 | 6,481.50 | +0.33% | +10.20% |

NASDAQ 100 | 23,652.44 | +1.01% | +12.57% |

VIX | 15.19 | -1.24% | -12.30% |

10-Year Treasury Yield | 4.10% | -3.69% | -10.34% |

Gold | $3,594.65 | +4.22% | +36.97% |

Oil | $62.05 | -3.07% | -13.57% |

Market News

EU Levies $3.2 Billion Fine on Google, Prompting Trump Tariff Threats Amid Growing Transatlantic Tensions

Alphabet’s Google has been fined €2.95 billion (approximately $3.2 billion) by the European Commission for abusing its dominance in the online advertising sector through self-preferencing, granting its own ad services an unfair advantage over rivals. Competition chief Teresa Ribera asserted that an effective solution may require a structural remedy, such as forcing Google to sell part of its Adtech business. Google has been given 60 days to propose compliance measures or face further regulatory action. The tech giant vociferously denied any wrongdoing, vowing to appeal and warning that the penalty could harm thousands of European businesses by disrupting their ability to generate revenue.

The dispute escalated internationally when U.S. President Donald Trump denounced the EU’s fine as “very unfair,” suggesting it targeted “American ingenuity,” and warned that the U.S. could retaliate by imposing tariffs on European goods. This standoff comes as Brussels and Washington are in delicate trade negotiations, worsened by concerns over the timing of the announcement. Last year, Google faced a U.S. antitrust ruling that brought new restrictions, though not a breakup of its business. Both U.S. and EU regulators have steadily intensified pressure on Google’s advertising practices, underlining the rising intersection of competition policy and global trade.

Saudi-Led OPEC+ Opts for Modest October Output Hike Amid Demand Uncertainty

OPEC+ announced it will increase oil production by 137,000 barrels per day beginning in October, a move led by Saudi Arabia as the group prioritizes regaining market share despite forecasts of weaker global demand. The new output bump is significantly smaller than recent monthly hikes and marks a surprise early unwinding of some prior production cuts, with OPEC+ stating it still holds the option to accelerate, pause, or reverse these changes depending on market conditions. According to analyst Jorge Leon, the decision is less about volumes and more about sending a message that OPEC+ will act to defend its place in the global oil market, even at the risk of lower prices. The alliance’s next policy review is scheduled for October 5.

This year’s output growth comes as Saudi Arabia increases pressure on members like Kazakhstan for exceeding quotas and the UAE ramps up expansion efforts amid Western sanctions on Russia and Iran. U.S. President Donald Trump has also pushed for higher output to tamp down gasoline prices at home. While oil prices have declined roughly 15% in 2025, supporting OPEC+’s confidence for further increases, most members are near capacity, leaving additional supply possibilities primarily in Saudi Arabia and the UAE. The result is a cautious strategy as OPEC+ works to unwind deep production cuts implemented since the pandemic, balancing market share ambitions with the risks of oversupply and price volatility.

Tesla Considers Landmark $1 Trillion Pay Package for CEO Elon Musk Amid Growth Targets

Tesla’s board of directors has proposed a new compensation package for CEO Elon Musk that could ultimately be worth up to $1 trillion over the next decade, making it one of the largest corporate pay offers in history. The plan, disclosed in a recent regulatory filing, would award Musk about 423 million shares — valued at $143 billion based on current prices — if Tesla achieves ambitious milestones related to profitability, electric vehicle production, and market capitalization. To receive the full payout, Musk must steer Tesla to an $8.5 trillion market cap, deliver 20 million vehicles, and oversee the manufacturing of 1 million robotaxis and 1 million Optimus humanoid robots, all by 2035. “It’s time to change that,” the board said in a letter to shareholders, noting there is no current long-term CEO performance award in place to retain Musk’s leadership.

The new pay proposal comes as Tesla faces recent operational and financial challenges, including its first annual sales decline in more than a decade and shrinking profits. The company’s previous $56 billion pay award for Musk was revoked by a Delaware court following investor lawsuits over fiduciary concerns, highlighting ongoing legal scrutiny of Musk’s compensation. Despite a 2025 slump, Tesla's stock has risen over 54% in the past year, signaling ongoing investor confidence. Industry analysts such as Dan Ives from Wedbush emphasize the critical role Musk’s leadership will play as Tesla enters a pivotal phase focused on autonomy and robotics, while the company aims to cement his leadership at least through 2030.

Anthropic to Pay $1.5 Billion in Historic Settlement Over AI Copyright Case

Anthropic, an artificial intelligence company backed by Amazon and Alphabet, has agreed to a $1.5 billion settlement to resolve a class-action lawsuit brought by authors who claimed their copyrighted books were used without permission to train Anthropic’s AI chatbot Claude. The settlement proposal, submitted to U.S. District Judge William Alsup in San Francisco, is described by the plaintiffs as the largest publicly reported copyright recovery ever, surpassing all prior class action or individual copyright awards. Authors Andrea Bartz, Charles Graeber, and Kirk Wallace Johnson initiated the lawsuit last year, alleging that Anthropic used millions of pirated books to develop its AI systems.

This landmark settlement, if approved, would be the first of its kind among several similar lawsuits targeting major tech companies, including OpenAI, Microsoft, and Meta, over the use of copyright-protected material in generative AI. Despite Judge Alsup ruling in June that Anthropic's use of the authors' works for training Claude was “fair use,” he also found the company violated rights by storing over seven million pirated books in an internal “central library.” A trial previously scheduled for December was expected to determine damages, which could have stretched into the hundreds of billions. The broader legal debate over fair use and AI remains unresolved, as courts continue to address parallel cases in the tech industry.

Robinhood Enters S&P 500 as Market Value Soars to $90 Billion

Robinhood Markets, the brokerage firm renowned for propelling the 2020 meme-stock craze, is set to join the S&P 500 index on September 22, according to S&P Dow Jones Indices. The inclusion represents a major milestone for the company, which now boasts a market capitalization of approximately $90 billion — well above the S&P 500’s $22.7 billion entry threshold. Robinhood’s addition, alongside AppLovin and Emcor Group, will require index-tracking funds to rebalance and purchase shares, typically providing a boost to the stock price. The firm joins established financial giants in the index, such as Charles Schwab, Morgan Stanley, and Goldman Sachs.

Supporting this leap, Robinhood’s stock closed Friday at $101.25, marking a 1.6% decline, but saw a 6% rise in after-hours trading. Its share price has nearly tripled in 2025, driven by surges in crypto and options trading, which fueled a 65% year-over-year increase in second-quarter trading revenue. The company has also expanded into new business areas, including credit cards and wealth management, reflecting its evolution beyond its origins in speculative trading. Analyst attention remains focused on how Robinhood positions itself within the intensified competition among financial services firms.

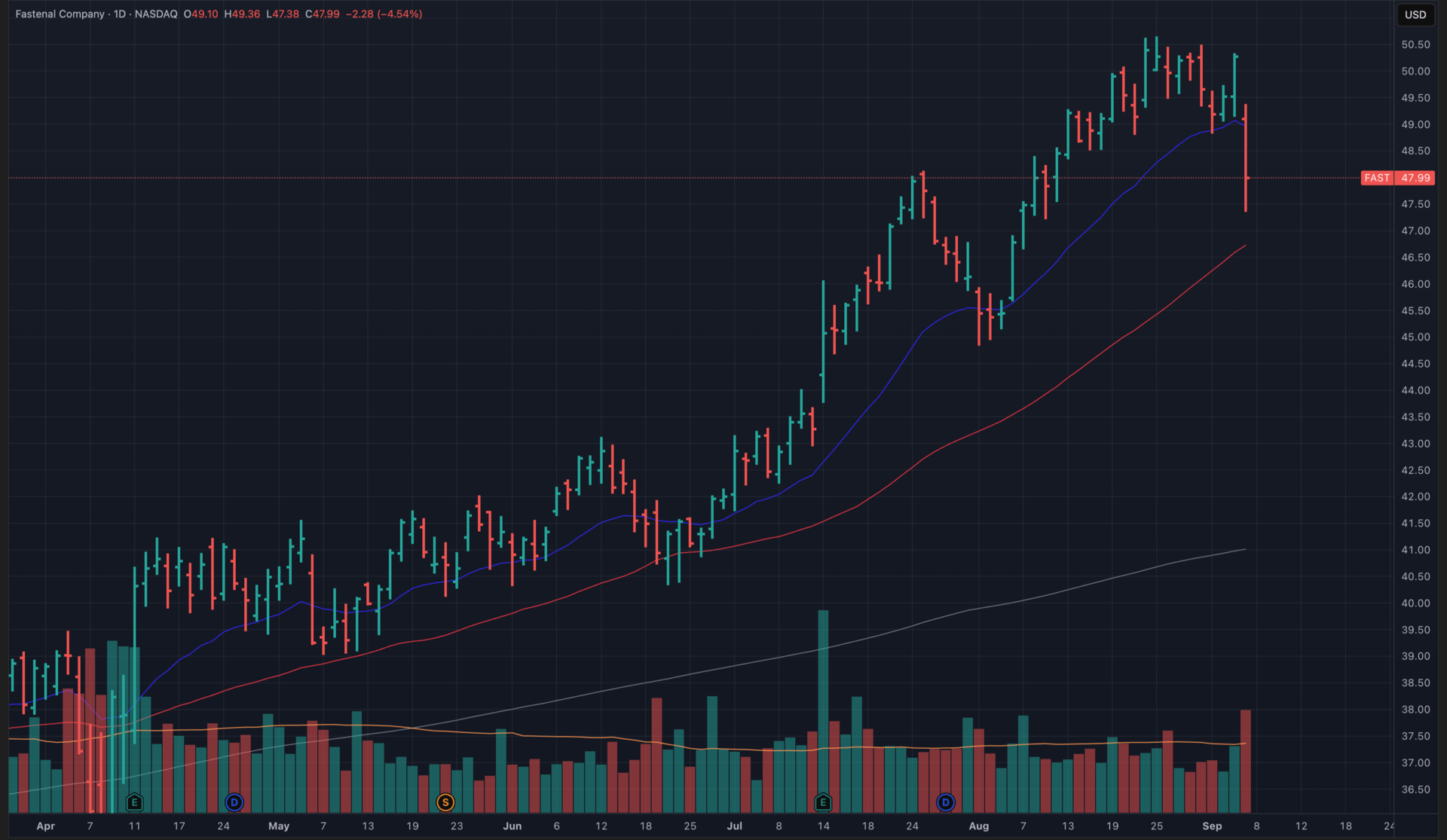

Editor’s Chart of the Day

Spotlighting Fastenal Company (FAST) — a leader in the distribution of industrial and construction supplies, including fasteners, safety products, and maintenance solutions — this chart captures how FAST has capitalized on robust sector-wide momentum to cement its place as one of the market’s standout names. After powering to retest its August highs last Thursday, shares eased back to the 50-day moving average, echoing the recent cooldown seen across industrials as a whole. With $45 now emerging as the critical support level, and a noticeable uptick in institutional selling sweeping through the once-scorching sector, FAST’s next act will be closely watched.

Despite the turbulence, FAST’s year-over-year returns remain top tier, outperforming 75% of all U.S. stocks, which is a remarkable achievement in today’s highly competitive landscape, especially for an industrial heavyweight. Management remains upbeat, guiding toward a solid 9.0% revenue increase and an 11.2% jump in earnings for fiscal 2026, underscoring the company’s strong execution. If the sector regains its footing after a period of consolidation, FAST is poised to re-emerge as a momentum leader, making it a name to watch for investors seeking both resilience and growth.

Major Earnings

Oracle Corporation (ORCL) – September 9, After Market Close

Financial Trends: Oracle projects fiscal 2026 annual revenue of $66-67 billion with 16% growth driven by cloud momentum.

Strategic Initiatives: The Stargate AI partnership with OpenAI and massive data center expansion totaling $25+ billion capex aims to capture the AI infrastructure boom.

Key Metrics: Investors will focus on cloud infrastructure revenue growth trajectory toward the guided 70%+ target and remaining performance obligations (RPO) expansion beyond the current $138 billion.

Progress: Oracle achieved 52% cloud infrastructure growth in Q4 2025 reaching $3 billion while total cloud revenue hit $6.7 billion with 27% growth.

Focus Areas: Management will update on AI GPU capacity additions, multicloud partnership monetization, and conversion of the record backlog into recognized revenue.

Risks Potential: Supply chain constraints on AI chips, execution challenges with rapid data center buildout, and competitive pressure from hyperscale cloud providers remain key headwinds.

Concerns: The company's 53.7x P/E ratio reflects high expectations while negative free cash flow of $2.9 billion in Q4 due to heavy capex spending raises sustainability questions.

Market Trends: Enterprises are accelerating AI infrastructure investments and multicloud adoption, driving demand for Oracle's database and cloud services across hybrid deployments.

GameStop Corporation (GME) – September 9, After Market Close

Financial Trends: GameStop expects annual revenue around $3.8 billion for fiscal 2025 with declining hardware and software sales offset partially by collectibles growth.

Strategic Initiatives: The company's digital transformation includes a $500 million Bitcoin investment, NFT marketplace expansion, and the GameStop Digital Assets Hub generating $5 million in early transaction fees.

Key Metrics: Investors will track collectibles revenue momentum after Q1's 54.6% surge to $211.5 million and gross margin expansion from the higher-margin segment mix.

Progress: Collectibles now represent 28.9% of total sales compared to 15.5% a year ago while the company completed $450 million in international restructuring.

Focus Areas: Management will address the sustainability of collectibles growth, digital asset monetization progress, and operational efficiency improvements from cost reduction initiatives.

Risks Potential: Continued declines in core gaming hardware and software sales, crypto market volatility affecting treasury holdings, and execution risks in digital transformation.

Concerns: Q2 EPS estimates of -$0.10 versus Q1's $0.17 beat reflect transition costs while meme stock volatility creates unpredictable trading dynamics.

Market Trends: The shift toward digital gaming and collectibles culture supports GameStop's pivot strategy while retail gaming faces ongoing structural headwinds.

Adobe Inc. (ADBE) – September 11, After Market Close

Financial Trends: Adobe targets fiscal 2025 annual revenue of $23.5-23.6 billion with non-GAAP EPS of $20.50-20.70 driven by AI innovation and subscription growth.

Strategic Initiatives: The company is integrating Firefly AI across Creative Cloud applications and launching agentic AI capabilities to enhance productivity and expand market reach.

Key Metrics: Investors will monitor Digital Media ARR growth rate of 11% annually, AI product revenue approaching $250 million, and operating margin sustainability around 46%.

Progress: Q2 2025 delivered record revenue of $5.87 billion with 11% growth while Creative Cloud innovations including AI-powered features drive user engagement.

Focus Areas: Management will update on AI monetization acceleration, competitive positioning against emerging AI tools, and Creative Cloud Pro adoption rates.

Risks Potential: Intensifying competition from Canva, OpenAI, and other AI-native creative tools threatens market share while AI development costs pressure margins.

Concerns: The stock's 30% decline over 52 weeks reflects investor skepticism about AI monetization pace despite strong financial performance.

Market Trends: Creators increasingly demand AI-integrated workflows while enterprises seek personalized digital experiences, supporting Adobe's innovation strategy.

Meet Evan Buenger

Evan Buenger, Editor of the Bull and Bear Brief

From a young age, Evan was fascinated by the stock market. At just 11 years old, he received a Wall Street Journal subscription for his birthday, sparking a lifelong passion for investing. Evan spent his formative years studying the strategies and philosophies of legendary investors like Paul Tudor Jones, Stanley Druckenmiller, and George Soros, absorbing their wisdom and developing his own unique approach to the markets.

As Evan's knowledge grew, he began to incorporate the time-tested, technically-based strategies of trading legends like William O'Neil and Richard Wyckoff into his own investment framework. By borrowing elements from each and rigorously testing them in real-time, Evan created a powerful conglomerate strategy that encompasses fundamentals, technicals, and macroeconomics.

Today, Evan is a professional trader and was a top contender in the 2020 US Investing Championship. His extraordinary performance, with a 141.8% return, is a testament to his studious background, well-informed approach, and unwavering dedication to his craft.

At the core of Evan's strategy is identifying stocks that benefit from sector trends and rotation. By combining fundamental analysis with a focus on relative strength and advanced technical analysis techniques, Evan is able to identify the stocks that are most likely to move higher or lower over the intermediate term.

While he keeps a close eye on macroeconomic trends, his willingness to adapt to changing market conditions, as well as his developed ability to know when to and not to act in a fast-moving market, is what sets him apart. Evan has consistently demonstrated his ability to navigate even the most challenging investment environments. His impressive track record and unique perspective make him a valuable voice in the world of finance, and he is thrilled to have the opportunity to share his insights and expertise with subscribers of the Bull and Bear Brief.

Subscribe to Stock Portfolio Recommendations Newsletter to read the rest.

Become a paying subscriber of the Bull and Bear Brief: Stock Portfolio Recommendations Newsletter to get access to this post and other subscriber-only content.

Upgrade to Stock Portfolio Recommendations NewsletterA subscription gets you:

- Expert-curated stock trades delivered weekly to strategically build your wealth-generating portfolio

- Real-time position management with timely alerts on existing holdings—ensuring you capture profits and minimize losses with precision timing

- Monthly Q&A where we address paid subscriber questions, examine real-world scenarios, and discuss current market conditions

- Regular reviews of both successful and unsuccessful trade recommendations, analyzing what worked, what didn't, and the lessons we can extract