Market’s Week in Review

September 22-September 26, 2025

Short-Term ETF Price Targets

ETF | Short-Term Target |

|---|---|

SPY | $650 |

QQQ | $584 |

Week’s Market Performance

Index | Current Level | Percent Change: Week | Percent Change: Year-to-Date |

|---|---|---|---|

S&P 500 | 6,643.70 | -0.31% | +12.96% |

NASDAQ 100 | 24,503.85 | -0.50% | +16.62% |

VIX | 15.32 | -1.03% | -11.55% |

10-Year Treasury Yield | 4.16% | +1.09% | -9.00% |

Gold | $3,766.72 | +2.22% | +43.53% |

Oil | $65.31 | +3.96% | -9.03% |

Market News

AI Megaprojects Test Investors’ Patience as Costs Soar, Revenues Lag

Tech giants are pouring hundreds of billions of dollars into AI data centers, chips, and power—on a scale surpassing the interstate highway system’s inflation-adjusted cost—with little clarity on when returns will materialize. North Dakota’s Ellendale, population 1,100, is the unlikely backdrop for a $15 billion “AI factory,” emblematic of a build-out fueled by heavy debt and escalating capex from Microsoft, Meta, Alphabet, Amazon, and middlemen like CoreWeave. Executives including Satya Nadella and Mark Zuckerberg signal urgency—Meta’s U.S. spend through 2028 “probably” near $600 billion—yet current AI revenues are comparatively small, with Morgan Stanley pegging 2024 AI product revenue around $45 billion. Consultants estimate $2 trillion in annual AI revenue will be needed by 2030 to justify the infrastructure, while OpenAI’s massive server commitments to Oracle and trillion-dollar expansion vision highlight a widening gap between ambition and monetization.

The frenzy evokes dot-com era overbuilds in fiber optics, with skeptics warning of “collective hallucinations” and citing weak enterprise ROI and slowing model breakthroughs, as each generation grows costlier to train and deploy. CoreWeave, once a small crypto miner, has leveraged debt and leases to amass Nvidia-powered capacity and $42 billion in contracts, including expanded deals with OpenAI, but faces duration mismatches between long-term leases and shorter client agreements. Local communities like Ellendale are betting on lasting growth amid risks, adding housing and infrastructure as construction doubles daytime population and permanent headcount is projected to rise by up to one-third. Supporters contend AI’s productivity gains could repay the spree—OpenAI cites 700 million weekly users of ChatGPT—yet veterans like Roger McNamee caution even great success may not validate today’s investment scale.

Resilient U.S. Economy Extends Expansion as Inflation and Hiring Slowdown Cloud Outlook

The U.S. economy remains on stable footing with recession risks appearing distant, supported by resilient consumer spending and a labor market that is softening but still historically firm. Recent data show personal consumption rose in August for a third straight month, and prior spring spending was revised higher to a 2.5% annual pace, helping offset the drag from trade tensions. The Federal Reserve cut interest rates last week amid weaker hiring—monthly job gains averaged just 27,000 from May to August, the worst stretch since 2010 outside the pandemic—but layoffs remain subdued. Jobless claims are still in the low 200,000s per week and the unemployment rate, at 4.3%, remains low by historical standards, sustaining household confidence enough to keep the expansion intact.

Inflation, however, has reaccelerated toward 3% after nearing the Fed’s 2% target earlier in the year, pressuring budgets and sentiment even as incomes outpace price gains for many workers. Americans are paying more for essentials such as rent, medical care, vehicles, and auto insurance, yet still have room for discretionary outlays on dining, travel, and recreation. Consumer surveys reflect unease: “Consumers continue to express frustration over the persistence of high prices,” said Joanne Hsu of the University of Michigan, noting fears of both higher inflation and weaker labor markets. Some economists warn aggressive rate cuts could “poke the inflation dragon again,” while others say the September jobs report—potentially delayed by a federal shutdown—will be pivotal in shaping the Fed’s path into 2026.

White House Shields Tariff Agenda With National-Security Powers as Court Test Looms

President Trump accelerated efforts to insulate his trade agenda from judicial review by invoking Section 232 national-security authority to extend tariffs across a wide array of imports, even as the Supreme Court prepares to hear challenges to separate levies imposed under emergency powers. The administration announced tariffs of 25% to 100% on pharmaceuticals, semi trucks, kitchen cabinets, and furniture beginning Oct. 1, and launched new inquiries that could target industrial machinery, robotics, medical devices, and protective gear, with additional actions pending on semiconductors and electronics. Legal experts note courts have traditionally deferred to presidents on national-security grounds, making Section 232 tariffs more resilient than those tied to the International Emergency Economic Powers Act, the basis for April’s “Liberation Day” tariffs and earlier measures tied to fentanyl trafficking that now face Supreme Court scrutiny in November. Ed Gresser of the Progressive Policy Institute said adding medical devices and industrial machinery “significantly” broadens the reach, while Cornell’s Eswar Prasad said the national-security rationale is “wearing increasingly thin” when applied to items like kitchen cabinets and upholstered furniture.

The Commerce Department has multiple Section 232 probes underway, including into timber, critical minerals, aircraft, and wind turbines, potentially extending the tariff regime’s footprint across supply chains. Industry groups warned of higher input costs: National Association of Manufacturers head Jay Timmons said tariffs on robots and machinery could raise expenses and “stall investment” in domestic factories, even as some sectors, such as heavy trucks made largely in the U.S., may see limited direct impact. Pharmaceutical tariffs are structured with exemptions for drugs produced domestically, and the administration says a forthcoming report will justify furniture as a national-security matter; EU imports would face a lower, already-agreed 15% rate rather than 100%. Commerce Secretary Howard Lutnick has also floated a credit scheme to push tech firms to source at least half their chips from U.S. producers, as the White House weighs broad semiconductor tariffs with possible carve-outs for companies building plants in Arizona and Texas.

China Halts U.S. Soybean Purchases, Deepening Farm-State Strains Amid Tariff Standoff

U.S. soybean sales to China have fallen to zero since May after Beijing imposed retaliatory tariffs in response to President Trump’s increased levies on Chinese goods, cutting off America’s largest soybean customer as the fall harvest begins. China bought $12.6 billion of U.S. soybeans last year—about 52% of all American soybean exports—but has stayed out of the market since the new marketing year began Sept. 1, pushing total U.S. soybean exports down 23% year-to-date. Prices have hovered near $10 a bushel, well below early-2024 levels around $13, and USDA weekly export reports have repeatedly shown no new Chinese purchases. Farmers and commodity handlers warn that a prolonged absence by Chinese buyers could strain storage capacity this fall, with some grain elevators considering halting soybean intake amid uncertainty over export demand.

The disruption coincides with China sourcing more from South America, aided by Argentina’s suspension of export taxes, which prompted Chinese firms to buy more than one million tons of Argentine soybeans, according to traders. Policymakers in farm-heavy states, including Senator Chuck Grassley of Iowa, have urged swift negotiations to restore market access, while the White House has signaled awareness of the strain: “We care very much about the fact that China has stopped buying our agricultural products,” said Kevin Hassett, the National Economic Council director. President Trump floated directing tariff revenue to farmers, though Agriculture Secretary Brooke Rollins said no relief plan is ready and urged diversification away from reliance on a single buyer “that isn’t aligned with our values”. With over half of U.S. soybean exports typically sold between October and December, industry analysts say continued Chinese abstention would leave growers “in a rough place” as harvest accelerates across key producing states.

Griffin Rebukes Tariff Exemptions, Defends Quarterly Reporting, Warns Against Politicizing the Fed

Citadel founder and CEO Ken Griffin sharpened his public criticism of the White House’s economic agenda in a CNBC interview, denouncing tariff carve-outs, proposals to end quarterly earnings reports, and efforts seen as undermining Federal Reserve independence. Calling company-specific tariff exemptions “nauseating,” Griffin argued that government “picking winners and losers” ensures “all of us lose,” pushing back on a key feature of the administration’s trade strategy. He also defended quarterly reporting, noting most firms already produce monthly financials and warning that longer disclosure gaps reduce market accountability. On the Fed, he cautioned that perceived presidential control would compromise the central bank’s ability to make “painful” but necessary decisions during economic stress.

Griffin’s remarks position him among a small group of Wall Street leaders openly challenging the administration’s economic policies, particularly on trade and market transparency. His critique of tariff exemptions echoed frustrations from multinational firms, including technology companies seeking relief on imported components. By emphasizing routine internal financial cadence, Griffin disputed claims that quarterly reports impose undue burdens, framing them instead as critical discipline for public markets. His defense of Fed autonomy underscores investor concerns about policy credibility and inflation management if central bank decisions are politicized.

Editor’s Chart of the Day

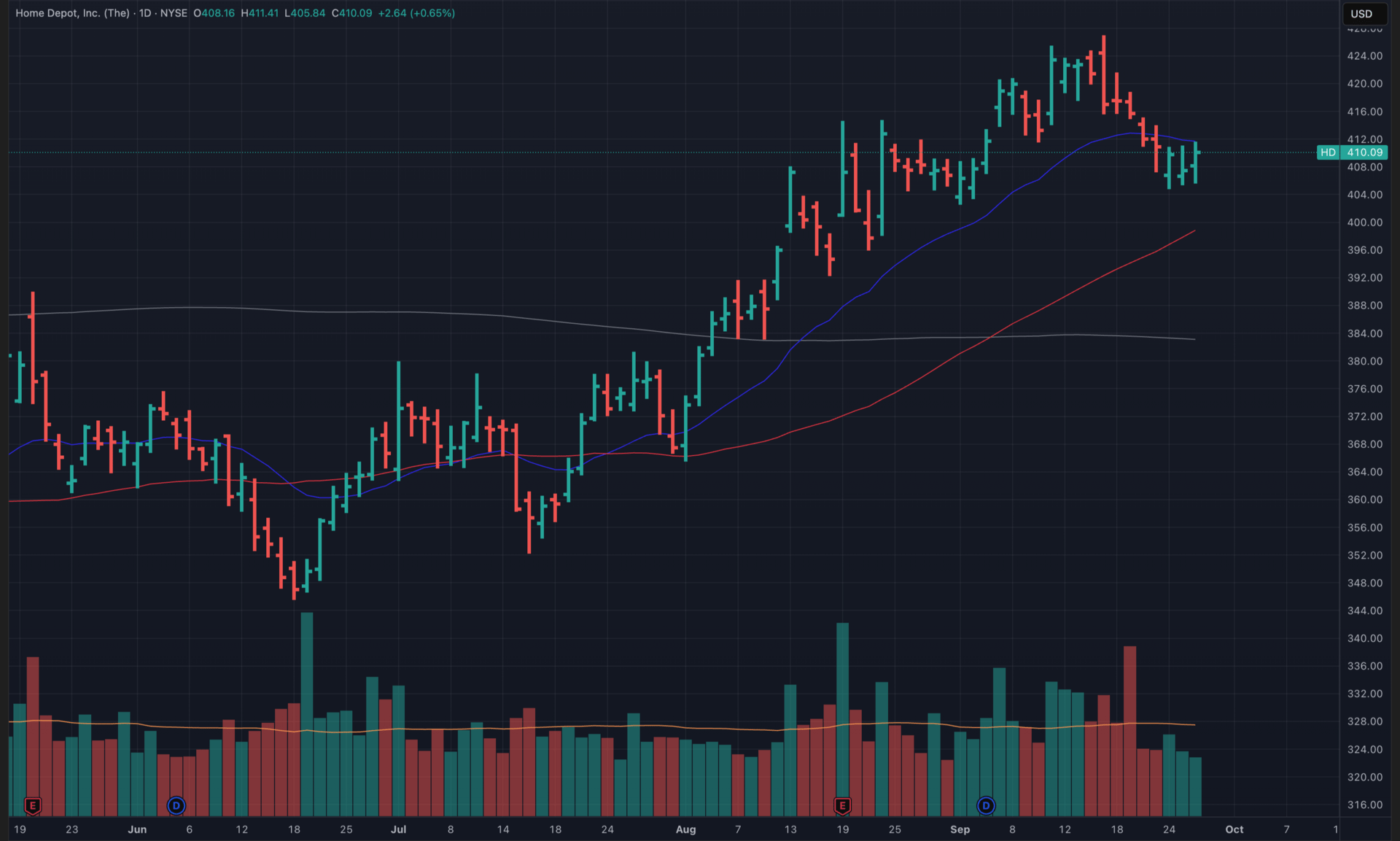

Spotlighting Home Depot, Inc. (HD) — Home Depot operates the largest home-improvement retail network in North America, serving DIY consumers and professional contractors with building materials, tools, appliances, and home services. Its scale, Pro customer focus, and integrated supply chain give it pricing power, merchandising breadth, and consistent cash generation through cycles.

After sprinting to $425, HD has drifted back toward its 20-day and 50-day moving averages—a classic, normal mean-reversion move that speaks to both solid execution and the broader resilience of U.S. demand. The $400–$410 range now shapes up as the near-term battleground where the 20-day and 50-day moving averages converge, a zone likely to magnetize order flow as institutional participation increases and consumer discretionary sector leadership cools into the end of the year. A clean hold above this area would keep the uptrend intact, while a decisive break below the 50-day moving average raises the odds of a range-bound period of trading as the stock digests gains.

Even so, secular crosscurrents remain. HD’s trailing 12-month return outpaces roughly six in ten U.S. stocks—impressive in a tape where AI and semiconductors siphon capital flows with eye-popping topline growth and narrative momentum. The engine here is a durable model—high inventory turns, tight vendor relationships, and rising Pro penetration—offset by structural headwinds like housing affordability, elevated insurance and labor costs, and tariff pass-through friction. Management’s guide—about 3.1% revenue growth and a -1.8% earnings decline for 2026—captures that push-pull between inflation relief and lingering cost absorption.

If retail stocks weaken further after this pullback, Home Depot looks set for chop rather than trend as fundamentals normalize and tariff uncertainty overhangs any good news—tough sledding when other corners of the market offer cleaner growth and margin stories. Still, the franchise quality is intact: Home Depot’s strong reputation, leading position in home improvement, and steady growth in serving both DIY customers and professionals mean the company should stay stable even if the stock doesn’t move much for now. This gives investors confidence to hold while waiting for a better buying opportunity or new catalyst for the stock to rise.

Major Earnings

Nike, Inc. (NKE) – September 30, After Market Close

Financial Trends: Nike projects fiscal 2026 annual revenue of approximately $45.61 billion with EPS estimated at $1.69, reflecting significant year-over-year declines as the company navigates its strategic transformation.

Strategic Initiatives: The "Win Now" strategy focuses on streamlining operations, sharpening sport performance focus, boosting innovation, and repositioning supply and distribution channels while reducing reliance on aging franchises like Air Force 1.

Key Metrics: Investors will monitor gross margin trajectory expected to compress 400-500 basis points, digital sales penetration, inventory management effectiveness, and Nike App user engagement metrics.

Progress: Q4 2025 delivered new product launches including Pegasus Premium and Vomero 18 with positive consumer response, while the 24/7 apparel collection exceeded sales expectations.

Focus Areas: Management will address progress on wholesale partnership recovery, inventory mix adjustments planned for fiscal 2026, promotional activity reduction in digital channels, and timeline for revenue stabilization.

Risks Potential: Tariff-related costs projected at $1 billion annually, competitive pressure in athletic apparel, and execution challenges with the strategic turnaround amid margin compression.

Concerns: Analysts forecast Q1 2026 EPS of $0.27 representing a 61% year-over-year decline, with revenue expected to fall 5.2% to approximately $10.99 billion.

Market Trends: Strategic pivot toward sport performance over lifestyle products aligns with consumer demand shifts, while aging demographics of core franchises require portfolio rebalancing.

Exxon Mobil Corporation (XOM) – October 6, After Market Close

Financial Trends: Exxon expects fiscal 2025 annual EPS of approximately $6.34 with 2026 projected at $7.15, supported by record upstream production and strategic project completions.

Strategic Initiatives: The company approved $6.8 billion investment in Guyana's Hammerhead project targeting 150,000 barrels per day by 2029, while expanding Singapore refining capabilities and low-carbon solutions.

Key Metrics: Investors will focus on upstream production volumes especially from Permian Basin and Guyana, refining margins amid global supply pressures, and progress toward 1.7 million barrels per day by 2030.

Progress: Q2 2025 achieved highest second-quarter production since Exxon-Mobil merger over 25 years ago, with Permian Basin producing record 1.6 million oil equivalent barrels per day.

Focus Areas: Management will update on 2025 project start-ups expected to drive $3 billion in 2026 earnings, carbon capture operations scaling, and capital allocation between growth and shareholder returns.

Risks Potential: Global fuel oversupply pressuring refining margins, geopolitical tensions affecting operations, and commodity price volatility impacting upstream earnings.

Concerns: Oil price forecasts suggest Brent declining to $56 by late 2026 with inventory builds exceeding 2 million barrels per day through Q1 2026.

Market Trends: Energy transition demands balanced with traditional hydrocarbon strength, while OPEC+ capacity constraints and Russian supply disruptions support near-term pricing.

Constellation Brands, Inc. (STZ) – October 6, After Market Close

Financial Trends: Constellation projects fiscal 2026 comparable EPS of $11.30-$11.60, down from previous guidance, with enterprise organic net sales expected to decline 4%-6%.

Strategic Initiatives: Management pursues $4 billion share repurchase program while focusing on premiumization trends and expanding low-alcohol product innovations across beer and wine portfolios.

Key Metrics: Investors will track beer segment margins amid 2%-4% sales decline expectations, distributor inventory management effectiveness, and wine/spirits segment stabilization efforts.

Progress: Beer segment remains resilient with Modelo Especial delivering double-digit volume growth and market share gains in Cheladas and Oro variants.

Focus Areas: Management will address tariff cost pressures, consumer spending patterns among core Hispanic demographics, and inventory optimization across distribution channels.

Risks Potential: Softening US beer consumption trends, intensified high-end market competition with increased promotional activity, and macroeconomic pressure on consumer discretionary spending.

Concerns: Q1 2026 results missed expectations with $3.22 EPS versus $3.45 consensus, while wine/spirits segment faces $1.5-2.5 billion goodwill impairment risk.

Market Trends: Health and wellness trends reducing alcohol consumption among younger demographics, while premiumization continues supporting higher-end brand positioning despite volume pressures.

Meet Evan Buenger

Evan Buenger, Editor of the Bull and Bear Brief

From a young age, Evan was fascinated by the stock market. At just 11 years old, he received a Wall Street Journal subscription for his birthday, sparking a lifelong passion for investing. Evan spent his formative years studying the strategies and philosophies of legendary investors like Paul Tudor Jones, Stanley Druckenmiller, and George Soros, absorbing their wisdom and developing his own unique approach to the markets.

As Evan's knowledge grew, he began to incorporate the time-tested, technically-based strategies of trading legends like William O'Neil and Richard Wyckoff into his own investment framework. By borrowing elements from each and rigorously testing them in real-time, Evan created a powerful conglomerate strategy that encompasses fundamentals, technicals, and macroeconomics.

Today, Evan is a professional trader and was a top contender in the 2020 US Investing Championship. His extraordinary performance, with a 141.8% return, is a testament to his studious background, well-informed approach, and unwavering dedication to his craft.

At the core of Evan's strategy is identifying stocks that benefit from sector trends and rotation. By combining fundamental analysis with a focus on relative strength and advanced technical analysis techniques, Evan is able to identify the stocks that are most likely to move higher or lower over the intermediate term.

While he keeps a close eye on macroeconomic trends, his willingness to adapt to changing market conditions, as well as his developed ability to know when to and not to act in a fast-moving market, is what sets him apart. Evan has consistently demonstrated his ability to navigate even the most challenging investment environments. His impressive track record and unique perspective make him a valuable voice in the world of finance, and he is thrilled to have the opportunity to share his insights and expertise with subscribers of the Bull and Bear Brief.

Subscribe to Stock Portfolio Recommendations Newsletter to read the rest.

Become a paying subscriber of the Bull and Bear Brief: Stock Portfolio Recommendations Newsletter to get access to this post and other subscriber-only content.

Upgrade to Stock Portfolio Recommendations NewsletterA subscription gets you:

- Expert-curated stock trades delivered weekly to strategically build your wealth-generating portfolio

- Real-time position management with timely alerts on existing holdings—ensuring you capture profits and minimize losses with precision timing

- Monthly Q&A where we address paid subscriber questions, examine real-world scenarios, and discuss current market conditions

- Regular reviews of both successful and unsuccessful trade recommendations, analyzing what worked, what didn't, and the lessons we can extract