Market’s Week in Review

December 5-December 11, 2025

Short-Term ETF Price Targets

ETF | Short-Term Target |

|---|---|

SPY | $684 |

QQQ | $624 |

Week’s Market Performance

Index | Current Level | Percent Change: Week | Percent Change: Year-to-Date |

|---|---|---|---|

S&P 500 | 6,827.41 | +0.45% | +16.08% |

NASDAQ 100 | 25,196.73 | -0.02% | +19.91% |

VIX | 15.81 | -3.51% | -8.72% |

10-Year Treasury Yield | 4.184% | +0.48% | -8.57% |

Gold | $4,299.38 | +1.93% | +63.82% |

Oil | $57.45 | -4.03% | -19.98% |

Market News

Oracle’s A.I. Splurge Rattles Markets as Investors Question OpenAI Bet

Oracle shares dropped about 13 percent in premarket trading after the company reported weaker-than-expected revenue and profit and disclosed that its already aggressive artificial intelligence spending will rise further, intensifying investor concern over whether its massive bet will pay off. The company said capital expenditures are now expected to reach about $50 billion through May 2026, $15 billion more than forecast in September, and it burned through $10 billion in cash in the most recent quarter while already carrying roughly $106 billion in debt. Analysts at Morgan Stanley project that Oracle’s debt could climb to about $290 billion by 2028, and the cost of insuring its debt via credit default swaps has roughly tripled since September to about 1.25 percent, signaling rising credit risk. The sell-off has spilled over unevenly to other A.I.-linked names, with CoreWeave and SoftBank falling in premarket and Tokyo trading, while the larger “Magnificent Seven” tech giants have seen comparatively smaller declines.

A central worry is Oracle’s heavy reliance on OpenAI, which is privately held and at the center of the current A.I. boom but faces mounting scrutiny over its vast, trillion-dollar spending ambitions and intensifying competition from richer rivals like Google. OpenAI still represents the majority of roughly $523 billion in contracted but unrecognized revenue on Oracle’s books, prompting investors to vent their doubts about OpenAI’s trajectory via publicly traded partners such as Oracle and SoftBank. Oracle executives have pointed to new partnerships with companies like Meta and Nvidia and stressed that other customers could use the capacity being built for OpenAI, underscoring efforts to diversify demand for its expanded infrastructure. The situation highlights how deeply interconnected the A.I. ecosystem has become, and how financial strain or strategic missteps at one key hub such as OpenAI could reverberate across suppliers, investors, and the broader market narrative around the A.I. boom.

Rivian Shares Slide as EV Maker Bets on In-House AI Chip for Self-Driving Push

Rivian Automotive Inc. shares fell as much as 10% in New York after the electric-vehicle maker unveiled its own artificial intelligence chip, the Rivian Autonomy Processor 1 (RAP1), which is intended to replace Nvidia Corp. hardware in future models as part of a broader automated-driving strategy. The company plans to equip its upcoming R2 sport utility vehicles with RAP1 chips and a new lidar sensor produced with Taiwan Semiconductor Manufacturing Co., aiming to eventually offer autonomous driving capability. Chief executive RJ Scaringe called the move a “huge commitment” years in the making and said the new chip dramatically improves performance while cutting hardware costs by hundreds of dollars per vehicle. Despite the technological ambitions, investors were underwhelmed, with the stock retreating after an initial bounce as executives wrapped up a presentation on the system.

Two RAP1 chips will power Rivian’s next-generation Autonomy Compute Module 3, which the company says can process 5 billion pixels per second and deliver four times the performance of the Nvidia-based system in current vehicles that still require constant driver supervision. Rivian is pairing the hardware with a “Large Driving Model” software foundation and plans to roll out progressively more capable hands-free and eventually point-to-point driving features, starting on highways from 2027, as it targets a higher-margin software and subscription business. The first R2 vehicles, due in production in the first half of 2026, will ship without the new chip and lidar, while existing R1 owners will be offered an Autonomy+ software package for a one-time fee or monthly subscription. The initiative comes as Rivian continues to burn cash, produce fewer than 50,000 vehicles a year at its Illinois plant, cut jobs, and trade more than 80% below its post-IPO highs, even as partners like Volkswagen commit billions to joint ventures and Scaringe signals openness to eventually licensing Rivian’s driver-assistance technology to other automakers.

Lilly’s Experimental Obesity Shot Shows Major Weight Loss and Pain Relief in Late-Stage Trial

Eli Lilly reported that its experimental obesity drug retatrutide led to average weight loss of up to 28.7% of body weight after more than a year of treatment in a Phase 3 study, a result that exceeds the performance of current blockbuster weight-loss medicines. In the 68-week trial, which enrolled people with obesity and knee osteoarthritis but without diabetes, patients on the highest dose lost an average of 71.2 pounds, compared with typical losses of about 22.5% on Lilly’s Zepbound and under 20% on Novo Nordisk’s Wegovy. The drug, which mimics three gut hormones to curb appetite and boost energy expenditure, also significantly reduced osteoarthritis knee pain, suggesting potential use for patients with both severe obesity and joint complications. Lilly said the strong data could support a major new product that extends its fast-growing weight-loss franchise built on Mounjaro and Zepbound, and its shares rose about 1.2% in premarket trading following the announcement.

The study found that retatrutide’s side effects were largely gastrointestinal, including nausea and diarrhea, similar to other drugs in the class but at somewhat higher rates, according to J.P. Morgan analyst Chris Schott, who noted they remained in line with expectations for such therapies. Some participants stopped treatment after losing too much weight, and analysts and company executives emphasized that the drug is aimed at people with very high body-mass index scores and substantial weight-loss needs. Kenneth Custer, president of Lilly Cardiometabolic Health, said the company believes retatrutide could become an important option for patients with significant obesity and related complications such as knee osteoarthritis. Lilly plans seven additional Phase 3 trials of retatrutide, which it expects to complete in 2026, as it works to define the drug’s broader role in obesity care and related conditions.

OpenAI Rolls Out GPT-5.2 Amid Intensifying AI Arms Race

OpenAI has unveiled GPT-5.2, described by the company as its most capable artificial intelligence model to date, with broad performance gains in writing, coding, and reasoning tasks. The release follows CEO Sam Altman’s recent internal declaration of a “code red,” signaling a company-wide push to rapidly upgrade ChatGPT in response to mounting competitive pressure. The move comes as Google and other major tech rivals escalate their own AI efforts, positioning OpenAI’s latest launch as both a product update and a strategic signal in the escalating AI race. GPT-5.2 is being marketed as a significant step forward in sophistication and reliability for end users and developers who rely on ChatGPT’s underlying models.

The article notes that OpenAI’s announcement arrives amid growing scrutiny of the AI sector, with concerns over safety, governance, and the pace of deployment shaping the environment in which GPT-5.2 is debuting. Altman’s “code red” directive underscores internal urgency to protect OpenAI’s market lead as Google’s Gemini and other systems challenge ChatGPT’s dominance. The company frames GPT-5.2 as a direct response to those pressures, touting improvements that aim to keep its tools attractive to both consumers and enterprise clients. By highlighting better performance across core benchmarks and positioning the release against a backdrop of intense competition, the rollout reflects how product development and strategic signaling have become tightly intertwined in today’s AI industry.

Tariffs Trim Monthly Trade Gap to Five-Year Low

The U.S. trade deficit in goods and services narrowed more than 10 percent from August to September, bringing the gap down to $52.8 billion, its lowest level since June 2020. Imports in September rose only 0.6 percent to $342.1 billion, while exports increased 3 percent to $289.3 billion, a shift that aligns with President Donald Trump’s goal of reducing the trade deficit through sweeping global tariffs. Economists and trade experts, however, caution against declaring success, noting that the data reflect temporary distortions from companies that rushed to import goods before tariffs took effect and then slowed orders once higher duties were in place. Some analysts argue that the president’s fixation on the trade deficit oversimplifies broader economic realities, even as administration officials such as U.S. trade representative Jamieson Greer publicly hail the tariffs for pushing the deficit “in the direction we want it to go.”

Secondary data in the article show that, despite the recent monthly improvement, the overall U.S. trade deficit for the year through September is still more than 17 percent higher than in the same period in 2024, with imports up 7.7 percent and exports up 5.2 percent. The tariff campaign has reshaped trade flows, reducing U.S. imports from China and narrowing the bilateral deficit, while increasing imports from other Asian countries and contributing to record trade surpluses for China globally. Sector-specific effects are uneven: U.S. soybean exports to China have fallen, automotive trade has been weak, but exports of natural gas, corn, computers and airplanes have risen, and shifts in gold and pharmaceutical trade have altered bilateral balances with Switzerland and Ireland. The article also notes that the U.S. effective tariff rate has climbed above 16 percent, the highest since 1935, while manufacturing construction and jobs have shown little sign of benefiting, and looming Supreme Court decisions on tariff legality could further disrupt trade policy in the coming weeks.

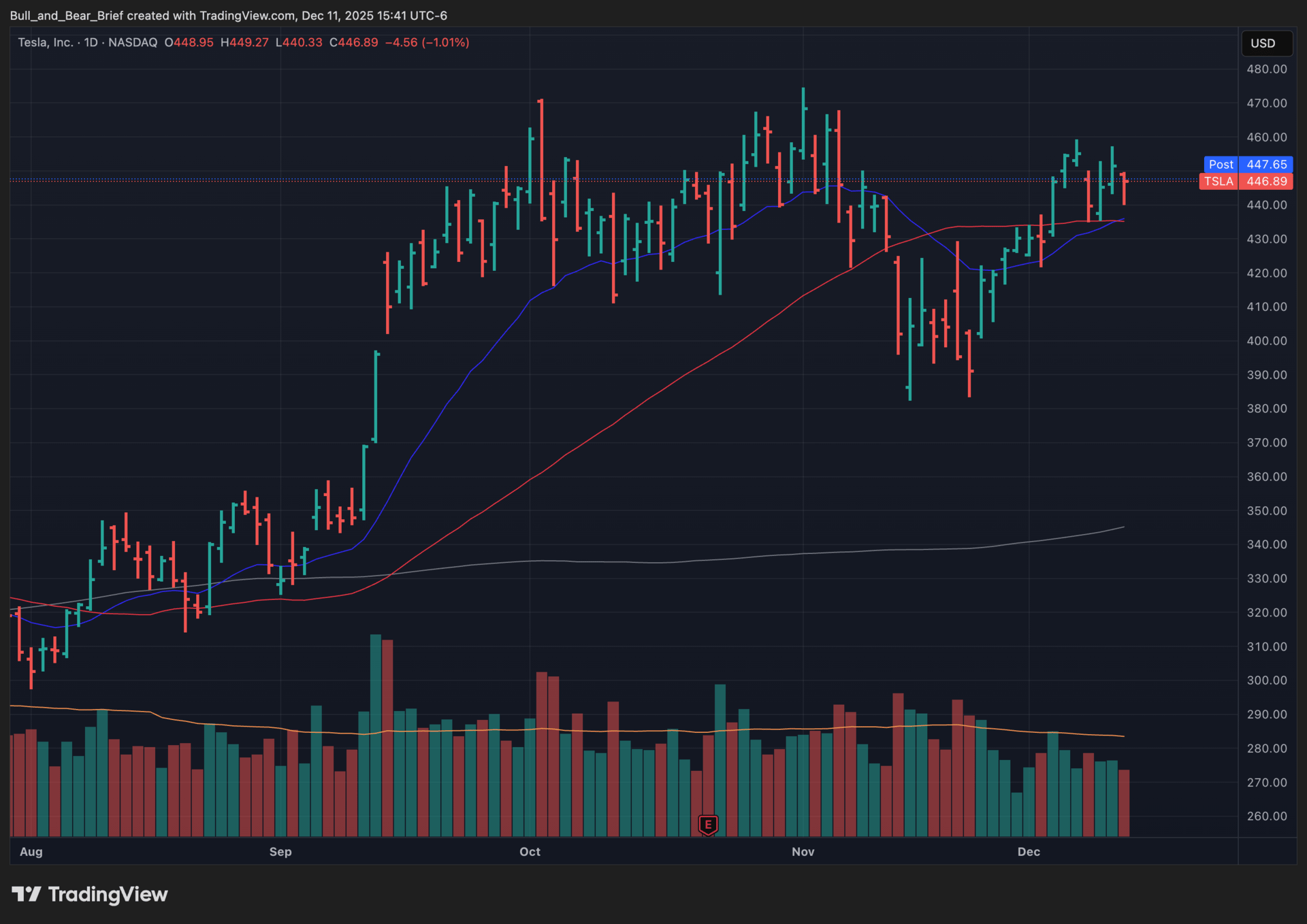

Editor’s Chart of the Day

Spotlighting Tesla Inc. (TSLA) — Tesla designs and manufactures electric vehicles, energy storage solutions, and solar products, generating most of its revenue from automotive sales while also building out a growing high-margin software and services stack around autonomous driving and energy management. The company operates globally with Gigafactories across the U.S., Europe, and China that support its vehicle, battery, and energy businesses at scale.

Following a difficult stretch characterized by declining comparable sales and pressured earnings, TSLA shares have spent much of the year trading sideways within a broad range. Recent attempts to break out to new highs have stalled as investors reassess the company’s medium-term fundamentals, leaving the stock sensitive to shifts in sentiment rather than clear, decisive trends. A decisive move below well-watched support in this range would raise the probability of a more extended downturn, with TSLA likely trading more in line with broader consumer discretionary risk appetite if the macro backdrop weakens further.

Even so, Tesla’s trailing 12‑month performance still outpaces the S&P 500, with the stock up roughly 12–26% versus roughly 14% for the index, supported by its historical sector leadership and powerful global brand. Operationally, management continues to prioritize cost reductions, factory efficiency, and disciplined capital allocation while pushing software and services—such as Full Self-Driving (FSD) features—to deepen monetization of the installed base. Leadership has also emphasized accelerating product cycles and manufacturing innovation (including next‑generation platforms and more automated production) as key levers to restore earnings momentum.

Looking ahead, management’s guidance calls for an inflection toward roughly 15% revenue growth in 2026, with an ambitious target of more than 50% earnings growth driven by operating leverage from higher volumes, improved factory utilization, and a rising mix of high-margin software and energy revenue. Upside to these targets would likely depend on successful ramp of refreshed vehicle models, further cost declines in batteries, and scaling of FSD and energy-storage deployments.

If consumer demand in the EV category softens further and pricing pressure intensifies, management believes Tesla’s cost position, brand strength, and diversified revenue mix would allow it to defend share and protect profitability better than peers, though growth could still moderate versus current expectations. For long-term investors, the key will be waiting for technically healthier setups—orderly pullbacks that hold key moving averages—combined with major catalysts such as next‑gen vehicle launches, regulatory or commercial breakthroughs in autonomous driving, or a significant step-up in energy and storage profits to reestablish sustained leadership in the tape.

Major Earnings

Lennar Corporation (LEN) – December 16, 2025, After Market Close

Financial Trends: Lennar is tracking toward modest annual revenue contraction in 2025 with a rebound to mid‑20% EPS growth in 2026 as efficiency gains and mix offset pricing and margin pressure.

Strategic Initiatives: Management is executing a production‑first, affordable‑price strategy, leveraging higher incentives, technology, and scale to maintain volume while integrating acquisitions like Rausch Coleman to broaden entry‑level exposure.

Key Metrics: Investors will focus on annual homebuilding revenue and EPS, gross margin around the high‑teens, SG&A as a percentage of sales, orders, community count, and backlog dollars given affordability and incentive trends.

Progress: Recent quarters showed revenue outperformance versus expectations but EPS misses as higher SG&A and incentives weighed on margins, while orders, community count, and liquidity remained solid.

Focus Areas: Expect the call to center on pricing power and incentives, gross‑margin trajectory, demand and order trends by region, backlog quality, and any color on 2026 volume and earnings growth targets.

Risks Potential: Key risks include persistent housing affordability constraints, elevated incentives, softer residential construction activity, and potential macro slowing that could pressure volumes and margins.

Concerns: After recent quarterly EPS misses and guidance pointing to lower 2025 revenues, investors worry that further margin compression or weaker‑than‑expected 2026 EPS outlook could cap multiple expansion.

Market Trends: Lennar is navigating a housing market characterized by affordability challenges, higher but stabilizing rates, and uneven regional demand, with builders competing aggressively on incentives to sustain orders.

Micron Technology, Inc. (MU) – December 17, 2025, After Market Close

Financial Trends: Micron is coming off a record fiscal 2025 with revenue around the high‑$30 billion range and EPS in the high single digits, with consensus looking for strong double‑digit annual EPS and revenue growth again in 2026 driven by AI‑centric memory demand.

Strategic Initiatives: Management is prioritizing high‑bandwidth memory and data‑center DRAM/NAND for AI workloads, tightening supply discipline, and advancing technology nodes to capture premium pricing in AI servers and advanced smartphones.

Key Metrics: Investors will key on full‑year revenue and EPS trajectories, HBM and data‑center revenue mix, bit supply growth versus demand, gross‑margin expansion, and capex plans given the intensity of AI infrastructure spending.

Progress: Fiscal 2025 saw nearly 50% revenue growth, sharp gross‑margin improvement, and a swing to robust profitability as AI‑related products ramped, validating the company’s strategy to pivot capacity toward high‑value segments.

Focus Areas: Expect the call to focus on AI‑server demand sustainability, pricing discipline, supply growth versus industry capacity additions, and updated commentary on fiscal 2026 earnings leverage as mix shifts further to HBM and data‑center solutions.

Risks Potential: Key risks include a potential pause in AI data‑center build‑outs, memory pricing volatility, elevated capex requirements, and geopolitical or trade disruptions affecting fabs and equipment supply.

Concerns: With the stock discounting strong AI‑driven growth, investors are sensitive to any moderation in revenue or margin guidance, hints of oversupply in DRAM/NAND, or slower‑than‑expected adoption of Micron’s latest HBM products.

Market Trends: Micron is leveraged to powerful secular trends in AI, cloud, and edge computing, but operates in a historically cyclical memory market where rapid capacity additions and macro slowdowns can quickly shift sentiment.

FedEx Corporation (FDX) – December 18, 2025, After Market Close

Financial Trends: FedEx is guiding to mid‑single‑digit annual revenue growth and mid‑teens EPS for fiscal 2026, reflecting cost‑cutting benefits and mix improvements despite still‑muted global freight and parcel volumes.

Strategic Initiatives: Management is executing the DRIVE cost‑reduction program, optimizing the air and ground networks, and preparing to spin off FedEx Freight to sharpen focus on higher‑return parcel and logistics operations.

Key Metrics: Investors will watch annual revenue and EPS run‑rate, operating margin by segment, progress on DRIVE savings, package yield and volume trends, and updates on the Freight spin‑off timing.

Progress: FedEx has already delivered billions in structural cost savings, returned significant capital via buybacks, and reaffirmed fiscal 2026 guidance for 4–6% revenue growth and a substantial EPS range in the high‑teens.

Focus Areas: The call will likely center on peak‑season execution, pricing power versus volume trade‑offs, incremental DRIVE savings, and how the Freight separation and network redesign will affect long‑term margins and capital intensity.

Risks Potential: Key risks include a softer global macro backdrop, pressure on express and international volumes, competitive pricing from rivals and regional carriers, labor and fuel‑cost volatility, and execution risk around the Freight spin‑off.

Concerns: With expectations for EPS acceleration already embedded, any hint of weaker revenue growth, slower‑than‑planned cost savings, or a more cautious fiscal 2026 outlook could weigh on the shares.

Market Trends: FedEx is navigating a parcel and freight market normalizing after pandemic peaks, with e‑commerce growth, supply‑chain reconfiguration, and “just‑in‑case” inventories supporting demand but offset by cyclical industrial softness and intense competition.

Meet Evan Buenger

Evan Buenger, Editor of the Bull and Bear Brief

From a young age, Evan was fascinated by the stock market. At just 11 years old, he received a Wall Street Journal subscription for his birthday, sparking a lifelong passion for investing. Evan spent his formative years studying the strategies and philosophies of legendary investors like Paul Tudor Jones, Stanley Druckenmiller, and George Soros, absorbing their wisdom and developing his own unique approach to the markets.

As Evan's knowledge grew, he began to incorporate the time-tested, technically-based strategies of trading legends like William O'Neil and Richard Wyckoff into his own investment framework. By borrowing elements from each and rigorously testing them in real-time, Evan created a powerful conglomerate strategy that encompasses fundamentals, technicals, and macroeconomics.

Today, Evan is a professional trader and was a top contender in the 2020 US Investing Championship. His extraordinary performance, with a 141.8% return, is a testament to his studious background, well-informed approach, and unwavering dedication to his craft.

At the core of Evan's strategy is identifying stocks that benefit from sector trends and rotation. By combining fundamental analysis with a focus on relative strength and advanced technical analysis techniques, Evan is able to identify the stocks that are most likely to move higher or lower over the intermediate term.

While he keeps a close eye on macroeconomic trends, his willingness to adapt to changing market conditions, as well as his developed ability to know when to and not to act in a fast-moving market, is what sets him apart. Evan has consistently demonstrated his ability to navigate even the most challenging investment environments. His impressive track record and unique perspective make him a valuable voice in the world of finance, and he is thrilled to have the opportunity to share his insights and expertise with subscribers of the Bull and Bear Brief.

Subscribe to Stock Portfolio Recommendations Newsletter to read the rest.

Become a paying subscriber of the Bull and Bear Brief: Stock Portfolio Recommendations Newsletter to get access to this post and other subscriber-only content.

Upgrade to Stock Portfolio Recommendations NewsletterA subscription gets you:

- Expert-curated stock trades delivered weekly to strategically build your wealth-generating portfolio

- Real-time position management with timely alerts on existing holdings—ensuring you capture profits and minimize losses with precision timing

- Monthly Q&A where we address paid subscriber questions, examine real-world scenarios, and discuss current market conditions

- Regular reviews of both successful and unsuccessful trade recommendations, analyzing what worked, what didn't, and the lessons we can extract