Market’s Week in Review

October 20-October 24, 2025

Short-Term ETF Price Targets

ETF | Short-Term Target |

|---|---|

SPY | $687 |

QQQ | $628 |

Week’s Market Performance

Index | Current Level | Percent Change: Week | Percent Change: Year-to-Date |

|---|---|---|---|

S&P 500 | 6,552.51 | -2.43% | +11.41% |

NASDAQ 100 | 24,211.75 | -2.27% | +15.27% |

VIX | 21.75 | +30.95% | +25.58% |

10-Year Treasury Yield | 4.04% | -2.06% | -11.80% |

Gold | $4,013.25 | +3.26% | +52.92% |

Oil | $58.94 | -3.52% | -17.91% |

Market News

Anthropic Courts Enterprises as OpenAI Chases Consumers, Setting Up a Split in AI Business Models

Anthropic is building its AI business around corporate customers, a strategy that is quickly narrowing the revenue gap with higher-profile rival OpenAI despite far less consumer reach. Backed by Amazon and Google, Anthropic says roughly 80% of its revenue comes from businesses and recently reported about 300,000 corporate customers, helping it reach a $7 billion annual run rate with expectations of $9 billion by year-end. Menlo Ventures estimates Anthropic now leads overall enterprise large-language-model market share at 32% versus OpenAI’s 25%, and dominates coding use cases with an estimated 42% share to OpenAI’s 21%. Microsoft underscored Anthropic’s enterprise traction by adding Claude to its Copilot suite despite its extensive partnership with OpenAI.

OpenAI, meanwhile, has amassed more than 800 million weekly users and a roughly $13 billion annual revenue run rate, driven largely by consumers replacing search queries with chatbot interactions, but it still faces a murky path to monetizing mass-market usage at scale beyond subscriptions. Ads could be the obvious next step, but integrating advertising into conversational interfaces presents challenges, especially against Google’s entrenched ad machine. OpenAI’s broader cultural profile—such as allowing adult-themed chats and pushing lighter-touch regulation—could deter risk-averse enterprises seeking reliability over edginess, even as the company deepens its own corporate push through Microsoft and direct sales. Independent benchmarks from Vals AI rank Anthropic’s latest Claude model at the top for finance, legal, and coding tasks, reinforcing its enterprise-first pitch, as investors Amazon and Google look prescient in backing a steadier, ROI-driven path to AI adoption.

Tesla’s FSD v14 Sharpens Highway Manners, Hazard Avoidance and Speed Control in Broad Update

Tesla’s latest Full Self-Driving (Supervised) v14 release delivers notable on-road improvements over v13, according to Teslarati journalist Joey Klender, who has tested the software for weeks. The new build, which began rolling out as v14.1.4, targets a “brake-stabbing” issue some owners reported in v14.1.3 while refining lane etiquette on highways, no longer lingering in the left lane after passing slower traffic. The system shows greater awareness of merging and cross traffic, executing courteous gaps on crowded expressways and allowing cross-street vehicles to enter during rush hour, with multiple examples shared via dashcam and social clips. Klender writes that several v13 pain points have been resolved, marking “significant progress” in the fourth iteration of Tesla’s semi-autonomous suite.

Beyond highway behavior, v14 demonstrates improved confidence around slow or unpredictable road users and better object avoidance, including smooth maneuvers around a dead animal on the highway after earlier inconsistency avoiding debris in v13. Speed management is also streamlined: Tesla removed the separate Max Speed setting, making on-the-fly adjustments simpler via the right scroll wheel while stabilizing acceleration and cruising speeds on both local roads and highways. Klender, based in Pennsylvania, reports successful overtakes of mail trucks and Amish buggies on Lancaster routes, with only minor stutters observed. While some issues persist, the update’s broader gains in courtesy, consistency, and hazard response suggest Tesla is steadily iterating toward more naturalistic driving behavior.

Employers Brace for Steep Health Premium Hikes as Workers Shoulder Larger Share of Costs

U.S. employers and workers are confronting the fastest escalation in health insurance costs in years, with average family premiums reaching about $26,993 in 2025—up roughly 6%—and signs pointing to even sharper increases in 2026. A new KFF employer survey cited rising prescription drug costs, chronic disease, and higher post-pandemic utilization as key drivers, with workers contributing about $6,850 toward premiums on average. The five-year premium increase now totals about 26%, and benefits consultants warn that, absent meaningful cost controls, employer plans could face hikes approaching 9% next year. The outlook has intensified calls for policy action on price growth, even as companies weigh plan design changes and tighter coverage for costly drugs, including GLP‑1s used for weight loss and cardiometabolic conditions.

Employers’ constrained playbook suggests more cost shifting to employees through higher deductibles, narrower networks, and prior authorization, while specialty drug strategies tighten as budgets strain. Analysts note that premium pressures extend beyond the employer market, raising broader concerns for households if current trends persist into 2026. Industry voices warn of a “quiet alarm bell” as hospital prices, provider labor inflation, and deferred care continue to compound spending. With no obvious, scalable fix in sight, the debate over how to contain underlying healthcare prices is set to intensify, even as companies and workers brace for another year of higher costs.

Target to Cut 1,800 Corporate Roles in Largest Restructuring in a Decade as Sales Slide

Target will eliminate 1,800 corporate positions—1,000 layoffs and 800 open roles—as part of a broad restructuring aimed at speeding decisions and simplifying operations, according to an employee memo from Chief Operating Officer Michael Fiddelke. The cuts, representing roughly 8% of the corporate workforce, will be communicated to affected staff on October 28 and mark the retailer’s largest reduction in more than ten years. The move comes amid continued sales pressure: Target reported a nearly 1% year-over-year decline in net sales and almost 2% drop in comparable sales in the second quarter of fiscal 2025, with shares down more than 30% year-to-date as of October 24. CEO Brian Cornell backed Fiddelke—who will become CEO in February 2026—praising his role in the company’s Enterprise Acceleration Office to streamline processes and drive growth.

Fiddelke wrote that “too many layers and overlapping work” have slowed execution, framing the cuts as necessary to reduce complexity and “bring ideas to life” faster. The restructuring aligns with Target’s multi-year effort to leverage technology and data across the business, even as the company warns full-year 2025 sales are likely to decline. The layoffs arrive amid a softening labor market, where job gains have undershot earlier estimates and unemployment has risen to 4.3%, complicating prospects for displaced workers, according to cited federal data and economists. Research referenced in the article cautions that layoffs can carry hidden costs for productivity and innovation, but the company did not explicitly label the move as cost-cutting, positioning it instead as part of a broader pivot to restore performance.

Amazon Debuts Smart Glasses and ‘Blue Jay’ Robotics to Speed Deliveries, Pledges No Layoffs

At its Delivering the Future Summit in Milpitas, California, Amazon showcased new AI-driven tools to streamline logistics, including “Blue Jay,” a robotic arm that can pick and sort hundreds of millions of differently shaped items at a single station. Tye Brady, Amazon’s chief technologist for robotics, said the company’s automation strategy “augments and amplifies the human potential,” adding that “no current employees will be laid off” as robots boost efficiency and safety. The company also unveiled smart glasses for delivery drivers that keep hands free and guide package selection, eliminating the need to handle phones and reducing injury risk, according to Beryl Tomay, vice president of transportation. The demonstrations come as reporting has raised concerns that automation could reduce future hiring by hundreds of thousands, a characterization Amazon disputes.

Amazon reiterated sustainability commitments alongside the tech reveal, including plans for 100,000 electric delivery vehicles by 2030 and exploration of advanced power sources such as small modular nuclear, fusion, and geothermal to support AI data centers, said chief sustainability officer Kara Hurst. The company also highlighted disaster-relief tech kits equipped with solar, batteries, networking, and drones to aid post-storm assessments. Leadership framed the innovations as part of a broader “augmentation” philosophy, not replacement, with Brady saying the goal is “people and machines working together” for safer, faster deliveries. Amazon shares rose during the week as the company emphasized delivery speed gains and safety enhancements alongside its long-term workforce and energy strategies.

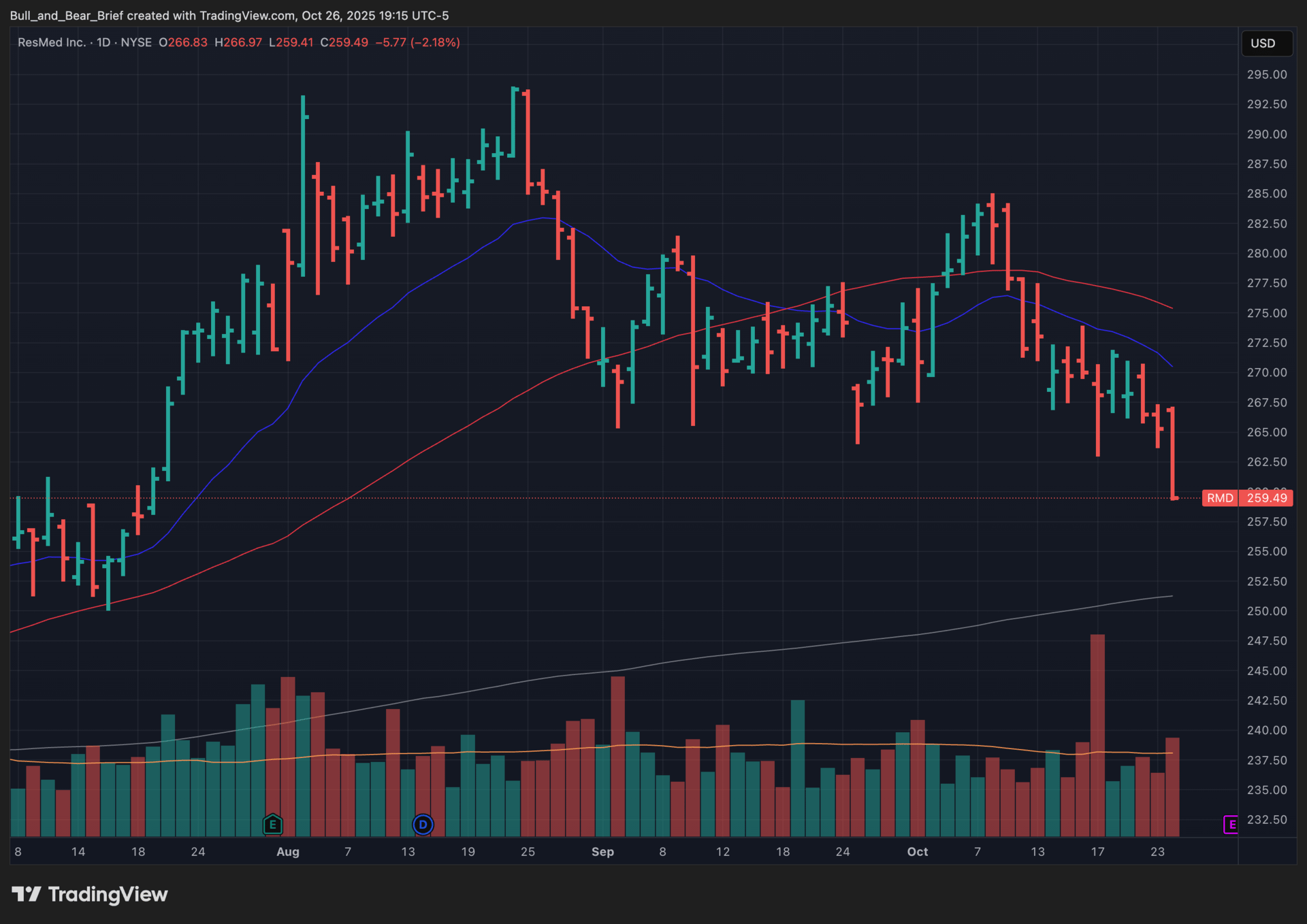

Editor’s Chart of the Day

Spotlighting ResMed Inc. (RMD) — A global leader in connected sleep and respiratory care, RMD develops and distributes CPAP and APAP devices, non-invasive ventilators, and cloud-connected patient management software that help treat sleep apnea, COPD, and other chronic respiratory conditions. Its portfolio spans Devices, Masks, and SaaS solutions (including Brightree and MatrixCare) that streamline workflows for providers and improve adherence for patients, with recurring mask and resupply revenue, data-driven platforms, and durable reimbursement frameworks anchoring cash flow visibility.

After a late-summer shakeout followed by several buyable tests of prior lows, RMD pushed decisively higher into early October, reclaiming its 20- and 50-day moving averages with limited resistance—classic action that implies accumulation by large institutions. The stock has since sold off in a brutal fall back well below prior buyable lows. Consistent closes above the 200-day keep an overall long-term uptrend as the base case, while a decisive break below the 200-day would tilt risk toward a deeper sell-off as the stock trades more with a choppy healthcare sector tape than with company-specific fundamentals.

Even so, RMD’s trailing 12-month return now stacks up competitively versus broader healthcare—no small feat in a market narrative dominated by AI and semis. Execution remains solid: RMD continues to convert device placements into high-margin recurring mask and resupply revenue, scale its cloud platforms for better patient engagement and provider efficiency, and reinvest in digital therapy, card-to-cloud connectivity, and COPD care expansion while maintaining disciplined capital returns. Management’s outlook calling for steady mid-single-digit revenue growth and faster EPS growth on mix and operating leverage points to resilient unit economics despite GLP-1 noise, reimbursement cadence, and macro variability.

If medtech and managed care remain soft, price action likely leans toward chop or a fade from highs—sound fundamentals, temporarily capped by sector headwinds. But fundamentally, RMD’s expanding installed base, embedded data ecosystem, and exposure to rising diagnosis and treatment rates for sleep apnea and chronic respiratory disease support a long-term compounding case anchored by recurring cash generation and shareholder returns. Long-term investors can stay patient, waiting for either a cleaner technical setup or the next fundamental catalyst—clinical data, software adoption milestones, or reimbursement/budget tailwinds—to reassert leadership.

Major Earnings

Welltower Inc. (WELL) – October 27, After Market Close

Financial Trends: Analysts expect full-year 2025 normalized FFO of $5.10 per share and revenue growth approaching 29% year-over-year, reflecting strong portfolio expansion and operational momentum across healthcare real estate segments.

Strategic Initiatives: Welltower has deployed $9.2 billion in acquisitions during 2025—including the $3.2 billion Amica Senior Lifestyles portfolio in Canada—while advancing negotiations for a £4 billion Barchester and Limecay acquisition in the U.K. to expand its senior housing footprint.

Key Metrics: Investors will focus on same-store NOI growth in the senior housing operating portfolio (targeting 11 consecutive quarters above 20%), occupancy improvements across the former Holiday by Atria properties, and progress integrating recent acquisitions.

Progress: Q2 2025 delivered record results with $2.55 billion revenue, $1.28 FFO per share beating estimates by $0.06, and senior housing operating portfolio NOI surpassing $2 billion for the first time while annualized company revenue exceeded $10 billion.

Focus Areas: Management will address integration progress on the $5.5 billion in contracted acquisitions expected to close in coming months, occupancy trajectory for the restructured Holiday portfolio now managed by six regional operators, and deployment strategy for the company's $119 billion market capitalization.

Risks Potential: Rising interest expenses amid elevated rates, execution risk on the massive $9.2 billion acquisition pipeline, and potential regulatory headwinds in international markets like the U.K. remain material concerns for the REIT.

Concerns: Q3 2025 consensus FFO estimate of $1.30 represents strong 17% year-over-year growth but sets high expectations following 11 consecutive quarters of 20%+ senior housing NOI gains, creating potential for disappointment if integration challenges emerge.

Market Trends: Aging demographics across North America and Europe drive sustained demand for senior housing and medical office properties, while healthcare real estate REITs benefit from limited new supply, institutional capital rotation into defensive sectors, and seniors' rising healthcare expenditures approaching record levels.

UnitedHealth Group Inc. (UNH) – October 28, Before Market Open

Financial Trends: Analysts project 2025 annual EPS of $16.16 representing a 42% decline from 2024 due to elevated Medicare Advantage medical costs, with 2026 estimates rebounding to $18.63 as pricing and benefit adjustments take effect.

Strategic Initiatives: The company withdrew and re-established full-year guidance in July after underestimating Medicare Advantage utilization trends, while advancing AI-driven billing automation through Optum Real and expanding value-based care arrangements serving over 103 million consumers.

Key Metrics: Investors will scrutinize the medical loss ratio targeting 89.25% ± 25 basis points for full-year 2025, Medicare Advantage membership growth following 505,000 net adds through H1 2025, and Optum Health's performance amid higher-than-expected patient acuity.

Progress: Q2 2025 generated $111.62 billion revenue with 12.9% year-over-year growth, though EPS of $4.08 missed estimates by $0.37 as Medicare Advantage medical cost trends reached 7.5% versus pricing assumptions of just over 5%.

Focus Areas: Management will update on Medicare Advantage margin stabilization as 2026 pricing anticipates medical cost trends accelerating to nearly 10%, Optum segment profitability improvements, and outcomes from the ongoing Department of Justice antitrust investigation.

Risks Potential: Medicare Advantage reimbursement pressures from CMS rate cuts and HCC risk adjustment model changes, elevated utilization trends spreading beyond Medicare into Medicaid and commercial segments, and regulatory scrutiny threaten earnings recovery.

Concerns: Q3 2025 consensus EPS of $2.80 reflects a catastrophic 61% year-over-year decline as the company absorbs $6.5 billion more in medical costs than originally anticipated, with management acknowledging medical trends "increased well beyond pricing and benefit design considerations."

Market Trends: Healthcare cost inflation accelerates across all payer segments as physician, outpatient, and specialty drug utilization surge post-pandemic, while Medicare Advantage faces structural headwinds from star ratings changes and intensifying regulatory pressure on risk adjustment practices that previously drove profitability.

Microsoft Corporation (MSFT) – October 29, After Market Close

Financial Trends: Analysts forecast fiscal Q1 2026 EPS of $3.11–$3.68 representing 11% year-over-year growth and revenue of $75.5 billion reflecting 14% expansion, with annual 2026 projections calling for total revenue of $322 billion and EPS of $15.24.

Strategic Initiatives: Microsoft is deploying over $30 billion in Q1 fiscal 2026 capital expenditures—an annualized $120–$125 billion run rate—to expand AI infrastructure including data centers, GPU capacity, and supercomputing capabilities across global markets including major investments in the U.K. and India.

Key Metrics: Investors will track Azure revenue growth projected at 36–39% year-over-year approaching $23–$30 billion quarterly, Intelligent Cloud segment revenue targeting $30.1–$30.4 billion (25–26% growth), and AI business contribution now exceeding $13 billion annual run rate up 175%.

Progress: Q4 fiscal 2025 delivered $76.4 billion revenue with Azure surpassing $75 billion annual revenue (39% quarterly growth), Microsoft Cloud reaching $46.7 billion (27% growth), and diluted EPS of $3.65 beating estimates by $0.30 while operating margin expanded.

Focus Areas: Management will address Azure capacity constraints expected to persist through first half fiscal 2026, capital expenditure scaling to meet AI infrastructure demand, margin trajectory as capex-to-sales ratio approaches 38%, and integration progress on GPT-5 across Microsoft 365, GitHub, and Azure AI Foundry.

Risks Potential: Massive capital expenditure commitments risk margin compression if AI monetization lags infrastructure investment, intensifying competition from Amazon AWS and Google Cloud in enterprise AI workloads, and regulatory scrutiny of Microsoft's dominant cloud position remain key concerns.

Concerns: Q1 fiscal 2026 guidance implies Azure growth deceleration to 37% from Q4's 39% due to capacity limitations, while the market debates whether record $120+ billion annual capex represents prudent AI leadership or excessive spending that pressures near-term profitability and free cash flow conversion.

Market Trends: Enterprise AI adoption accelerates across industries driving cloud infrastructure demand projected to grow 29% annually through 2032 reaching $356 billion, while hyperscaler competition intensifies as Amazon, Google, and Microsoft collectively deploy over $300 billion in AI data center investments creating unprecedented supply chain and energy demands.

Meet Evan Buenger

Evan Buenger, Editor of the Bull and Bear Brief

From a young age, Evan was fascinated by the stock market. At just 11 years old, he received a Wall Street Journal subscription for his birthday, sparking a lifelong passion for investing. Evan spent his formative years studying the strategies and philosophies of legendary investors like Paul Tudor Jones, Stanley Druckenmiller, and George Soros, absorbing their wisdom and developing his own unique approach to the markets.

As Evan's knowledge grew, he began to incorporate the time-tested, technically-based strategies of trading legends like William O'Neil and Richard Wyckoff into his own investment framework. By borrowing elements from each and rigorously testing them in real-time, Evan created a powerful conglomerate strategy that encompasses fundamentals, technicals, and macroeconomics.

Today, Evan is a professional trader and was a top contender in the 2020 US Investing Championship. His extraordinary performance, with a 141.8% return, is a testament to his studious background, well-informed approach, and unwavering dedication to his craft.

At the core of Evan's strategy is identifying stocks that benefit from sector trends and rotation. By combining fundamental analysis with a focus on relative strength and advanced technical analysis techniques, Evan is able to identify the stocks that are most likely to move higher or lower over the intermediate term.

While he keeps a close eye on macroeconomic trends, his willingness to adapt to changing market conditions, as well as his developed ability to know when to and not to act in a fast-moving market, is what sets him apart. Evan has consistently demonstrated his ability to navigate even the most challenging investment environments. His impressive track record and unique perspective make him a valuable voice in the world of finance, and he is thrilled to have the opportunity to share his insights and expertise with subscribers of the Bull and Bear Brief.

Subscribe to Stock Portfolio Recommendations Newsletter to read the rest.

Become a paying subscriber of the Bull and Bear Brief: Stock Portfolio Recommendations Newsletter to get access to this post and other subscriber-only content.

Upgrade to Stock Portfolio Recommendations NewsletterA subscription gets you:

- Expert-curated stock trades delivered weekly to strategically build your wealth-generating portfolio

- Real-time position management with timely alerts on existing holdings—ensuring you capture profits and minimize losses with precision timing

- Monthly Q&A where we address paid subscriber questions, examine real-world scenarios, and discuss current market conditions

- Regular reviews of both successful and unsuccessful trade recommendations, analyzing what worked, what didn't, and the lessons we can extract