Market’s Week in Review

October 27-October 31, 2025

Short-Term ETF Price Targets

ETF | Short-Term Target |

|---|---|

SPY | $687 |

QQQ | $628 |

Week’s Market Performance

Index | Current Level | Percent Change: Week | Percent Change: Year-to-Date |

|---|---|---|---|

S&P 500 | 6,840.20 | +0.71% | +16.30% |

NASDAQ 100 | 25,858.13 | +1.97% | +23.06% |

VIX | 17.41 | +6.22% | +0.52% |

10-Year Treasury Yield | 4.079% | +1.39% | -10.86% |

Gold | $4,001.12 | -2.69% | +52.46% |

Oil | $60.90 | -2.15% | -15.17% |

Market News

OPEC Plus Treads Carefully with Modest Oil Output Rise Amid Surplus Fears

Eight members of OPEC Plus announced a measured production increase of 137,000 barrels per day beginning in December but will pause additional hikes through the first quarter of 2026 due to concerns about potential oversupply. The group—which includes Saudi Arabia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman—cited seasonal declines in demand and market uncertainty as reasons for the cautious stance. Analysts, including Amrita Sen of Energy Aspects, noted this approach reflects internal forecasts of market “builds” and a need for flexibility in response to rapidly shifting oil market dynamics. Bachar El-Halabi of Argus Media said this pause will provide OPEC Plus with clearer insight into market fundamentals before committing to further moves.

Industry observers warn that oil supply may soon outpace demand, with the International Energy Agency’s Toril Bosoni projecting a global surplus of up to 4 million barrels a day in 2026 if current trends persist. Rising output from OPEC Plus and non-members like the United States, Canada, and Guyana risks exacerbating the imbalance, while recent sanctions on Russian oil companies and ongoing U.S.–Venezuela tensions add further complexity. Despite concerns, market indicators such as Brent crude’s pricing suggest continued demand, as highlighted in recent J.P. Morgan research. OPEC Plus, led by Saudi Arabia, appears intent on managing production levels to avoid both oversupply and damaging price shocks, balancing market stability with geopolitical considerations.

U.S.-China Accord Restores Critical Auto Chip Shipments as Trade Tensions Ease

Following a breakthrough deal between President Donald Trump and Chinese leader Xi Jinping, China’s Commerce Ministry has announced the easing of export restrictions on automotive semiconductors produced by Nexperia, a Dutch chip maker owned by China’s Wingtech. The move comes after weeks of halted shipments—prompted by the Dutch government’s seizure of Nexperia amid U.S.-China trade friction—that threatened car production worldwide, notably forcing Honda to suspend operations in North America. This diplomatic agreement, forged during the first face-to-face Trump-Xi meeting in six years, now permits Nexperia chips processed in China to resume shipping for qualifying cases, with the White House confirming the restoration of legacy chip flows critical to the global auto industry.

The dispute erupted in late September after the Dutch government intervened, citing national security concerns over technological know-how and responding to Wingtech’s presence on the U.S. trade blacklist. China’s subsequent export halt exposed the vulnerability of international supply chains, as Nexperia’s products are vital in hundreds of automotive components and difficult for manufacturers to replace quickly. Under the newly outlined framework, the U.S. has temporarily paused further export restrictions on Chinese subsidiaries, while China agreed to enhance controls on chemicals linked to illicit fentanyl production. The episode is the latest illustration of how trade fights and regulatory measures can ripple through global industries, with carmakers and suppliers left navigating uncertainty over long-term chip supplies.

Treasury Secretary Bessent Urges Further Fed Rate Cuts to Avert Broader U.S. Recession

Treasury Secretary Scott Bessent warned on Sunday that additional interest rate cuts by the Federal Reserve are needed to prevent parts of the U.S. economy from slipping into recession. Despite estimates showing economic growth near 4%, Bessent told CNN that several sectors are already in recession, citing the Fed’s policies as a cause of distributional problems across the economy. He specifically pointed to the ongoing “housing recession” and stressed that lowering rates would benefit lower-income households burdened by debt. The remarks continue the Trump administration’s pressure campaign on the Fed, following last week’s rate reduction and a signal from the central bank that further cuts in December are not guaranteed.

The situation is complicated further by a government shutdown, which has halted the release of vital economic data, leaving policymakers and markets without key performance indicators for the foreseeable future. Bessent did not specify which additional sectors might be at risk but emphasized that the lack of more aggressive Fed action could broaden recessionary pressures. The Federal Reserve’s most recent 0.25% rate cut, the second in a row, was sharply debated among policymakers, reflecting broader uncertainty about the future path of U.S. monetary policy as officials try to shield the jobs market from further weakening.

Banks Turn to Fed Repo Facility as Market Volatility Drives Record Demand for Liquidity

U.S. banks tapped the Federal Reserve’s Standing Repo Facility for a record $50.35 billion in loans on October 31 amid heightened month-end funding pressures, reflecting unusual volatility in short-term lending rates across financial markets. The surge in repo usage, which allows firms to access fast, collateralized cash, coincided with inflows of $51.8 billion into the Fed’s reverse repo facility. Market analysts attribute the spike to typical volatility around calendar endings, with lending rates on Friday climbing above the upper bound of the target range. Experts like Scott Skyrm of Curvature Securities noted that the volume of securities posted to the Fed uniquely matched the amount of cash drawn, demonstrating the facility’s intended function.

The increased demand for Fed liquidity tools comes as the central bank prepares to conclude its quantitative tightening program on December 1, after shrinking its balance sheet from a $9 trillion peak to $6.6 trillion. Federal Reserve Chair Jerome Powell emphasized during a press conference that current money market conditions now meet the criteria for “ample reserve” levels. Regional Fed presidents Lorie Logan and Beth Hammack expressed disappointment about the previously low usage of the repo facility, despite persistent market stress. Both encouraged banks to step up engagement with the tool to better stabilize reserve distribution amid ongoing financial fluctuations.

Investors Grow Wary as Big Tech’s Soaring AI Investments Face New Scrutiny

Major U.S. technology firms reported robust earnings for the third quarter, but cracks are emerging in the case for massive artificial intelligence spending. Companies including Meta Platforms, Microsoft, Alphabet, Amazon, Apple, Tesla, and Nvidia saw profits collectively rise about 27%, outpacing Wall Street expectations. While investors cheered the aggressive AI infrastructure spending by Amazon and Alphabet, Meta’s lack of immediate payoff from its AI investments triggered its steepest stock drop in three years. Microsoft’s Azure cloud business also disappointed, falling short on revenue growth targets and facing a negative market reaction. As Charles Schwab strategist Kevin Gordon noted, investors are increasingly demanding discipline and clearer returns from tech giants’ capital expenditures.

Despite these concerns, the sweeping “AI trade” continued to energize broad markets, with Nvidia’s shares soaring nearly 9% to hit a record $5 trillion valuation. Amazon’s stock surged almost 10%, buoyed by accelerated cloud growth and AI-driven initiatives expected to generate billions in new sales. Alphabet rallied 2.5% on strong Google Cloud and generative AI product sales, while other AI-related firms such as Seagate, Western Digital, Super Micro Computer, and Broadcom also posted strong weekly gains. Mixed reactions for Apple and Meta underscored that not all tech megacaps benefit equally from increased AI spending, revealing growing pressure for firms to justify and optimize these high-stakes investments.

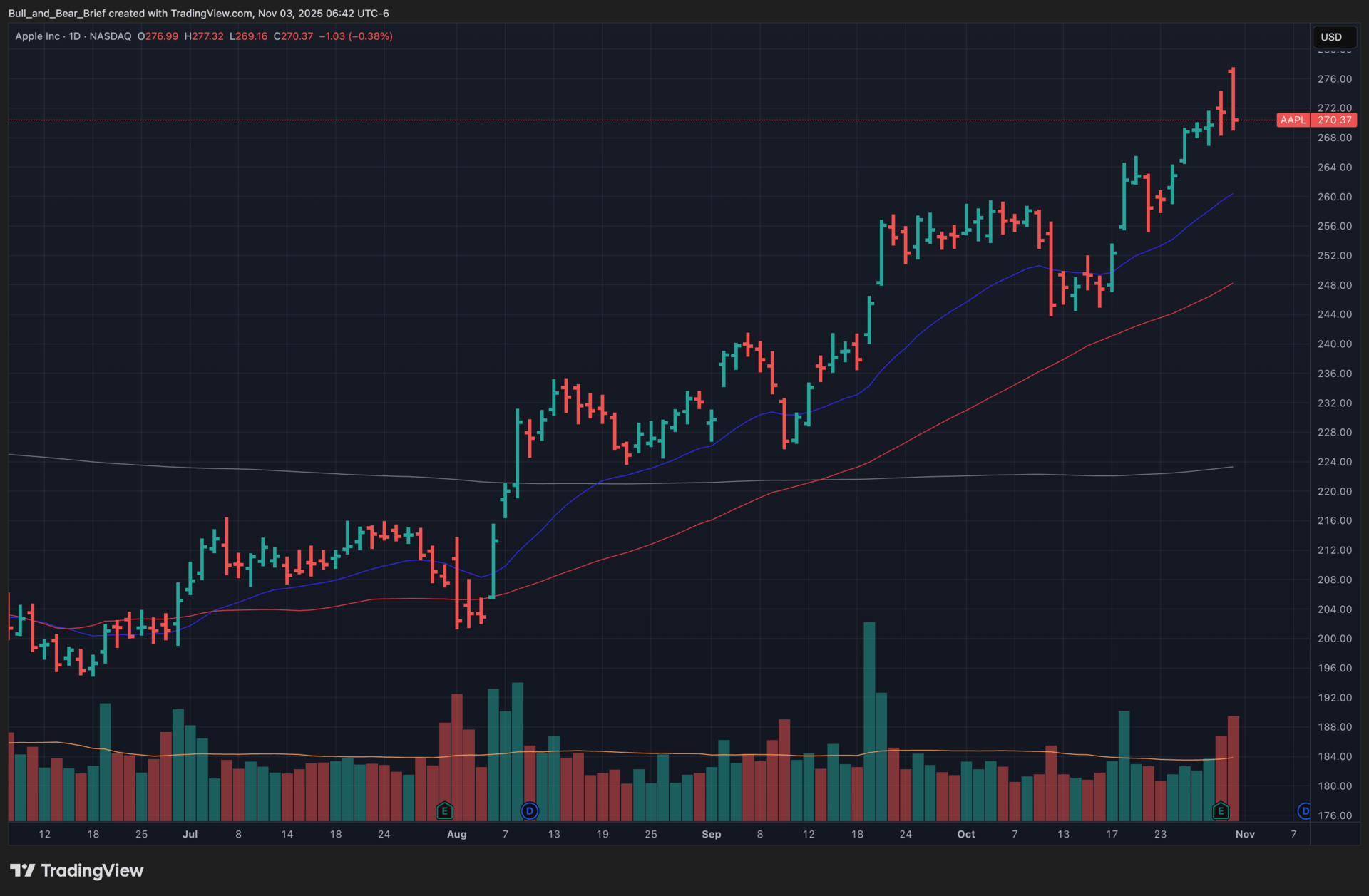

Editor’s Chart of the Day

Spotlighting Apple Inc. (AAPL) — A global leader in consumer electronics, digital services, and custom silicon, Apple manufactures the iconic iPhone, Mac, iPad, wearables, and smart home devices, while developing the world’s most valuable software ecosystem with the App Store, Apple Music, Apple TV+, iCloud, and Apple Pay. Its portfolio spans hardware, services, and proprietary chips (M-series, A-series) that together drive powerful recurring revenue, industry-defining platform lock-in, and unmatched global brand loyalty.

After a strong year led by the iPhone 17 cycle, record Services revenue, and double-digit growth in key product lines, AAPL reclaimed its 20-day and 50-day moving averages in June with institution-style accumulation, showcasing resilience even as mega-cap tech faces scrutiny over AI spending discipline and hardware saturation. The stock has recently pushed into new highs with the overall market, although its strong showing in the second half of this year may mean the stock needs some time to consolidate sideways before moving higher. A break below the 20-day or 50-day moving averages would increase risk for a deeper selloff, with shares possibly trading more with the tech sector than company fundamentals if the fortunes of the AI boom turn.

Apple’s trailing 12-month returns remain highly competitive against broader tech and the S&P 500, despite sector rotation and valuation headwinds, with AAPL outperforming 77% of stocks. Execution is strong: Apple continues to convert robust device sales into high-margin recurring Services revenue, aggressively invests in AI (“Apple Intelligence”), next-gen silicon, and new product categories while maintaining disciplined capital returns. Management’s outlook points to steady single-digit revenue growth and margin expansion driven by new devices, service mix, and operating leverage—even with global economic noise and competitive pressures.

If hardware demand and AI optimism soften tech, price action could lean toward choppiness or a fade from highs, but Apple’s fundamentals are anchored by its vast installed base, sticky ecosystem, explosive growth in India and emerging markets, and relentless R&D. Long-term investors can remain patient, watching for cleaner technical setups lower in the chart patterns combined with big catalysts—blockbuster device launches, major service additions, or strategic AI moves—to reassert leadership.

Major Earnings

Palantir Technologies (PLTR) – November 3, After Market Close

Financial Trends: Palantir’s annual revenue is forecast to top $4.14 billion with a robust 50% year-over-year pace and expanding operating margins north of 27%.

Strategic Initiatives: The AI Platform (AIP) and major US government contracts, such as the $10 billion Army deal, are driving both commercial and government segment expansion.

Key Metrics: Investors are focused on total contract value, US commercial/commercial growth rates, adjusted operating margins, and free cash flow levels.

Progress: Palantir has achieved rapid US commercial revenue growth of 93% and landed new billion-dollar deals in the UK and with Boeing.

Focus Areas: Analysts will scrutinize the pace of US commercial adoption, guidance for Q4 2025, European market stabilization, and any impacts from government shutdown risks.

Risks Potential: High customer concentration in US defense, a possible slowdown in government funding, and outsized reliance on key contracts pose ongoing risks.

Concerns: Valuation remains lofty—trading at over 30 times forward sales—and insider selling, plus margin pressure from stock-based compensation, could dampen sentiment.

Market Trends: Broader AI adoption and defense digitalization continue to support Palantir’s demand, but investor appetite for high-multiple software stocks remains volatile under higher interest rates and cyclical pressures.

Advanced Micro Devices (AMD) – November 4, After Market Close

Financial Trends: AMD's annual revenue continues to rise, with a recent record of $7.7 billion in one quarter and gross margins now stabilizing around 40–43% despite expense pressure.

Strategic Initiatives: Aggressive moves into AI infrastructure, vertical integration through acquisitions, and leadership in AI PCs have expanded AMD’s competitive footprint.

Key Metrics: Investors will focus on annual revenue growth, gross and operating margins, EPS, and market share in AI and enterprise segments.

Progress: Recent milestones include robust expansion of the Instinct MI350 series, strong Ryzen and EPYC processor demand, and multiple new AI partnerships.

Focus Areas: Management will likely prioritize updates on AI accelerator rollouts, cost controls, and integration of recent acquisitions on this call.

Risks Potential: Export controls on data center GPUs, supply chain volatility, and margin compression remain clear headwinds to watch.

Concerns: Analyst EPS expectations have outpaced company guidance recently, and high R&D costs continue to pressure operating leverage.

Market Trends: Rapid enterprise adoption of AI solutions and intensifying semiconductor competition—especially from Nvidia—are shaping industry sentiment and performance.

Robinhood Markets, Inc. (HOOD) – November 5, After Market Close

Financial Trends: Robinhood’s annual revenue approached $3 billion, net income jumped above $386 million, and diluted EPS doubled year-over-year, signaling strong operating momentum.

Strategic Initiatives: The firm accelerated expansion in active trading, banking, and crypto with Bitstamp and TradePMR acquisitions, plus multiple AI-driven and prediction market launches.

Key Metrics: Investors typically watch annual revenue, net income, EPS, funded accounts, platform assets, and growth in Robinhood Gold subscriptions.

Progress: Platform assets climbed above $298 billion, net deposits hit $13.8 billion, and robust product development brought new fintech offerings to market.

Focus Areas: Management is likely to address global expansion, profitability of new offerings, and integration of acquired businesses on the call.

Risks Potential: Regulatory pressures, low-margin competition, and cost management remain top risks as the firm enters new verticals and geographies.

Concerns: High P/E multiple and heavy investment spending have raised questions about the sustainability of profit growth and margin expansion.

Market Trends: Rapid fintech innovation, growing retail participation, and intensifying competition—in both traditional and digital finance—continue to shape market sentiment.

Meet Evan Buenger

Evan Buenger, Editor of the Bull and Bear Brief

From a young age, Evan was fascinated by the stock market. At just 11 years old, he received a Wall Street Journal subscription for his birthday, sparking a lifelong passion for investing. Evan spent his formative years studying the strategies and philosophies of legendary investors like Paul Tudor Jones, Stanley Druckenmiller, and George Soros, absorbing their wisdom and developing his own unique approach to the markets.

As Evan's knowledge grew, he began to incorporate the time-tested, technically-based strategies of trading legends like William O'Neil and Richard Wyckoff into his own investment framework. By borrowing elements from each and rigorously testing them in real-time, Evan created a powerful conglomerate strategy that encompasses fundamentals, technicals, and macroeconomics.

Today, Evan is a professional trader and was a top contender in the 2020 US Investing Championship. His extraordinary performance, with a 141.8% return, is a testament to his studious background, well-informed approach, and unwavering dedication to his craft.

At the core of Evan's strategy is identifying stocks that benefit from sector trends and rotation. By combining fundamental analysis with a focus on relative strength and advanced technical analysis techniques, Evan is able to identify the stocks that are most likely to move higher or lower over the intermediate term.

While he keeps a close eye on macroeconomic trends, his willingness to adapt to changing market conditions, as well as his developed ability to know when to and not to act in a fast-moving market, is what sets him apart. Evan has consistently demonstrated his ability to navigate even the most challenging investment environments. His impressive track record and unique perspective make him a valuable voice in the world of finance, and he is thrilled to have the opportunity to share his insights and expertise with subscribers of the Bull and Bear Brief.

Subscribe to Stock Portfolio Recommendations Newsletter to read the rest.

Become a paying subscriber of the Bull and Bear Brief: Stock Portfolio Recommendations Newsletter to get access to this post and other subscriber-only content.

Upgrade to Stock Portfolio Recommendations NewsletterA subscription gets you:

- Expert-curated stock trades delivered weekly to strategically build your wealth-generating portfolio

- Real-time position management with timely alerts on existing holdings—ensuring you capture profits and minimize losses with precision timing

- Monthly Q&A where we address paid subscriber questions, examine real-world scenarios, and discuss current market conditions

- Regular reviews of both successful and unsuccessful trade recommendations, analyzing what worked, what didn't, and the lessons we can extract