Market’s Week in Review

April 14-April 20, 2025

Short-Term ETF Price Targets

ETF | Short-Term Target |

|---|---|

SPY | $480 |

QQQ | $395 |

Week’s Market Performance

Index | Current Level | Percent Change: Week | Percent Change: Year-to-Date |

|---|---|---|---|

S&P 500 | 5,282.69 | -1.50% | -10.18% |

NASDAQ | 18,258.09 | -2.31% | -13.11% |

VIX | 29.66 | -21.01% | +70.56% |

10-Year Treasury Yield | 4.33% | -3.52% | -5.21% |

Gold | $3,328.4 | +2.58% | +26.03% |

Oil | $64.01 | +4.08% | -10.75% |

Market News

Google’s Monopoly Meltdown: Court Rulings Crack Tech Giant’s Ad Empire

Google is facing mounting antitrust challenges as it navigates a rapidly evolving technological landscape marked by the rise of artificial intelligence. On Thursday, a federal judge ruled that Google held illegal monopolies in online advertising markets, marking the second significant antitrust blow to the company within a year. This ruling follows a previous judgment in August, which found Google monopolizing the internet search market, the most consequential antitrust decision in the tech industry since the Microsoft case over two decades ago. The recent judgment in Alexandria, Virginia, highlighted Google's control over key segments of the advertising technology market, specifically the publisher ad server and ad exchange markets, while dismissing claims regarding general display advertising tools. The court's decision comes as Google grapples with cooling revenue growth and potential slowdowns in ad spending, exacerbated by economic uncertainties linked to President Donald Trump's new tariffs.

The impact of these legal challenges is profound, with Google's parent company, Alphabet, preparing to report first-quarter results next week amid a 20% decline in its stock price this year. U.S. District Judge Leonie Brinkema's ruling emphasized the substantial harm caused by Google's anticompetitive practices to publishers and web users, despite Google's assertion that publishers choose its ad tech tools for their simplicity and effectiveness. The Department of Justice views the ruling as a landmark victory, advocating for a breakup of Google's ad-tech business, potentially paving the way for competitors like Amazon to expand their market share. Meanwhile, Google plans to appeal the ruling, prolonging the legal battle and leaving publishers and advertisers in a state of uncertainty. The remedies trial, which will determine the consequences for Google's alleged monopolistic behaviors, is set to begin soon, with a final ruling expected by August. Industry experts, such as Gartner's Andrew Frank, note the structural complexities of Google's advertising ecosystem, suggesting that any regulatory actions could significantly alter the current market dynamics. As the appeals process unfolds, Google may face incentives to foster competition by loosening restrictions on platforms like YouTube, potentially benefiting smaller publishers and ad tech firms.

Quantum Leap: Google’s Secret Lab Aims to Fuse AI and the Future

Inside a secretive set of buildings in Santa Barbara, California, Alphabet's Google is making significant strides in quantum computing, aiming to develop the world's most advanced systems. Julian Kelly, director of hardware at Google Quantum AI, emphasized the potential synergy between quantum computing and artificial intelligence (AI), suggesting that their combined capabilities could revolutionize technological advancements. While Google was initially perceived as lagging in the generative AI space following OpenAI's release of ChatGPT in 2022, it has since sought to regain footing by unveiling a groundbreaking quantum computing chip named Willow. This chip reportedly solves complex problems at speeds unimaginable by classical computers and demonstrates a significant reduction in errors with the addition of more quantum bits, marking a pivotal milestone in the field, according to John Preskill from the Caltech Institute for Quantum Information and Matter.

Willow's capabilities may position Google at the forefront of the next technological era, offering a potential commercial advantage as AI models face limitations due to a lack of high-quality training data. Kelly posits that quantum computers could generate new, novel data, thus overcoming the current data scarcity faced by AI models. He cites AlphaFold, a Google DeepMind AI model that assists in studying protein structures and whose creators were awarded the 2024 Nobel Prize in Chemistry, as an example of AI's potential when informed by quantum mechanics. Quantum computers could enhance AI training by generating data informed by quantum mechanics, offering insights currently unavailable. Kelly projects that within five years, Google could achieve a practical quantum computing application that would be groundbreaking, though the challenge remains in translating this technological breakthrough into a profitable business model.

Tariff Turbulence Can’t Pause Nintendo’s Switch 2 Launch

Nintendo announced on Friday that preorders for its highly anticipated Nintendo Switch 2 gaming console will begin on April 24, 2025, with a starting price of $449.99. This announcement comes after a delay from the initial preorder date of April 9, which was postponed due to recent tariff changes announced by President Donald Trump. The tariffs, which include a significant 145% rate on Chinese goods and a reduced 10% on Vietnamese products, have prompted many electronics manufacturers, including Nintendo, to reassess their production strategies. Previously, Nintendo's Switch 1 consoles were produced in China and Vietnam, which makes the company particularly vulnerable to these new trade policies. Despite the tariff challenges, Nintendo has maintained the original pricing for the Switch 2 and its game bundles, including "Mario Kart World" priced at $79.99 and "Donkey Kong Bananza" at $69.99, as initially disclosed on April 2.

Nintendo expressed regret over the preorder postponement and assured customers of their commitment to delivering the Switch 2 by the launch date of June 5, 2025. The gaming giant also noted potential price adjustments for accessories, which will see increases ranging from $1 to $10 depending on the item. The excitement surrounding the Switch 2 launch is evident, with Best Buy announcing plans to open most of its stores at midnight on launch day, a first in six years, allowing eager customers immediate access to the new console. Industry analysts, such as those from Kantan Games, highlight the challenge Nintendo faces in convincing casual users to upgrade to the new system despite the pricing stability amidst tariff concerns. This move by Nintendo is seen as a strategic effort to navigate the complexities of international trade policies while sustaining consumer interest and market competitiveness.

Plastic Power Play: Capital One Seals $35B Deal for Discover

The Federal Reserve and the Office of the Comptroller of the Currency have officially approved Capital One Financial's $35.3 billion all-stock acquisition of Discover Financial Services. This merger, initially announced in February 2024, will see Discover shareholders receiving 1.0192 Capital One shares for each Discover share, representing a 26% premium over Discover's closing price of $110.49 at the announcement time. The approval process considered the financial and managerial resources of both companies, the needs of the communities served, as well as the competitive and financial stability implications of the merger. This significant deal will not only expand Capital One's deposit base but also its credit card offerings, as both companies are major players in the U.S. credit card market.

As part of the merger conditions, Capital One is required to adhere to the Federal Reserve's enforcement actions against Discover. The Fed had imposed a $100 million fine on Discover for overcharging interchange fees between 2007 and 2023, with Discover currently repaying affected customers. The Office of the Comptroller of the Currency has also mandated that Capital One takes corrective actions to address the root causes of Discover's outstanding enforcement issues. Once the deal is finalized, Capital One shareholders will own 60% of the combined entity, with Discover shareholders holding the remaining 40%. The companies anticipate closing the transaction by May 18. Jamie Dimon, CEO of JPMorgan Chase, remarked on the merger, emphasizing the importance of competition in the financial sector.

New War on the Water: U.S. Slaps Voyage Fees on China-Built Ships

The Trump administration announced new fees on Chinese-built vessels docking at U.S. ports following a joint investigation by the Biden and Trump administrations into China's shipbuilding practices. This move, announced by U.S. Trade Representative Jamieson Greer, is designed to counteract China's dominance in the shipbuilding industry, deemed detrimental to U.S. commerce. The fees, which will be charged once per voyage, aim to encourage the use of U.S.-built ships. China's practices in the shipbuilding sector have been criticized for giving Chinese companies an unfair advantage, and the new fees are seen as a measure to protect the U.S. economy and supply chain from these aggressive strategies.

The policy initially proposed a service fee of up to $1 million per Chinese-owned vessel and up to $1.5 million for non-Chinese-owned carriers with Chinese-built ships. However, following public hearings, these fees were adjusted to apply once per voyage rather than per port. The USTR also introduced a remission policy for vessel owners who order U.S.-built ships, providing an incentive to shift to domestically produced vessels. China's commerce ministry has condemned this move, accusing the U.S. of unjust practices and vowing to protect its interests. The World Shipping Council expressed concerns, warning that these fees could negatively impact U.S. consumers and industries without significantly benefiting the U.S. maritime industry. The initial phase of the fee implementation will see charges set to zero for the first 180 days, with categories based on vessel tonnage. The second phase will target LNG vessels, with restrictions gradually increasing over 22 years. Certain exemptions apply, such as for Great Lakes and Caribbean shipping and bulk exports like coal or grain.

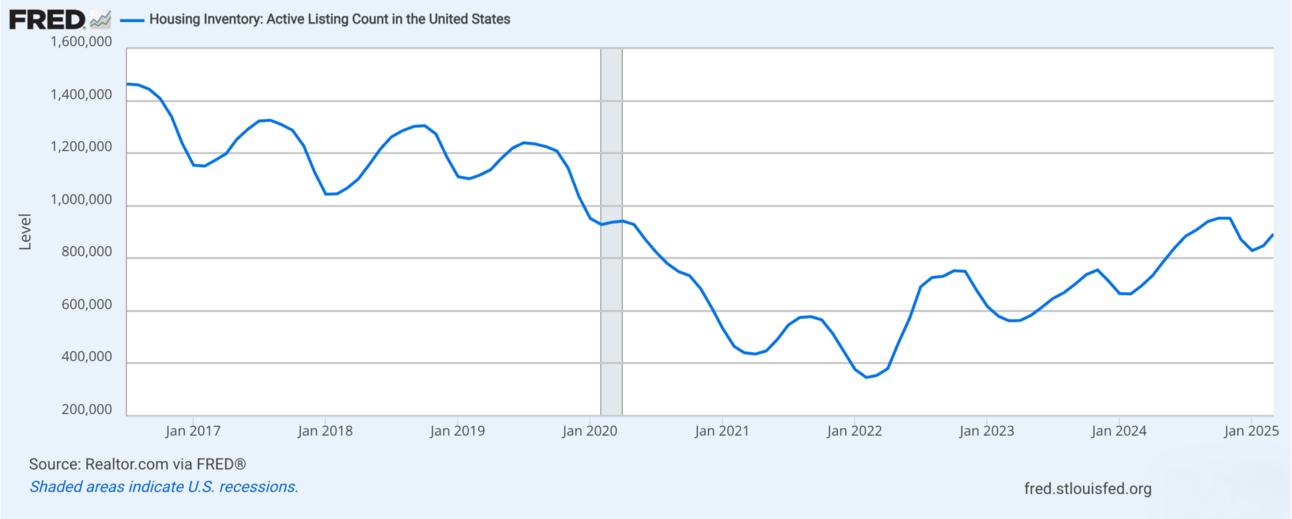

Editor’s Chart of the Day

This chart from FRED, via Realtor.com data, tracks the Active Listings of Housing Inventory in the United States from January 2017 to January 2025, showing a peak of about 1,400,000 listings in early 2017 followed by a decline starting in 2019 and a complete drop-off in 2020, which aligns with the COVID-19 pandemic. By early-2022, the inventory hit a low of approximately 400,000 listings, reflecting a significant drop during this period. Since then, a gradual recovery has occurred, with active listings rising to around 900,000 by early 2025, indicating a slow rebound in the housing market to near its pre-pandemic levels. Buyers may find it easier to snag a good deal on a house as active listings increase in coming months as housing supply finally reaches levels unseen since before the pandemic.

Major Earnings

PulteGroup Inc. (PHM) - April 22, Before Market Open

Recent quarters have shown record financial performance for PHM, with 2024 net income of $3.1 billion and revenue near $18 billion. However, Q1 2025 is expected to see a year-over-year EPS decline of about 14% to $2.47 and revenue down 2.2% to $3.86 billion, reflecting ongoing housing market headwinds.

Gross margins are under pressure, with home sales gross margin expected to fall to around 27% from 29.6% a year ago, as the company uses more incentives to address affordability challenges in a high mortgage rate environment.

Strategic initiatives include a focus on entry-level homes, prudent land investment, and targeted sales incentives, which have supported sales backlogs and inventory positioning for the spring selling season.

PHM’s average selling price is expected to rise to $560,000–$570,000, up from $538,000 last year, indicating some pricing power despite volume pressure.

Orders are forecast to increase modestly year-over-year, but total backlog value and units are expected to decline, reflecting a cautious demand environment.

Risks for the upcoming quarter include persistent high mortgage rates, affordability concerns, and potential margin compression from increased incentives and competitive dynamics.

The company’s operational changes, including faster construction cycles, are designed to offset market volatility and maintain profitability.

Investors should focus on management’s commentary regarding demand trends, margin outlook, and the effectiveness of affordability initiatives as key indicators for post-earnings positioning.

Tesla, Inc. (TSLA) - April 22, After Market Close

Tesla’s Q1 2025 is expected to show a sequential drop in revenue to about $21.8 billion and EPS of $0.42–$0.43, down from Q4 2024’s $27.2 billion and $0.74 EPS, reflecting a 13% year-over-year decline in vehicle deliveries and the weakest quarterly delivery performance in three years.

Gross margin and profitability remain pressured by slowing EV demand, competitive price cuts, and rising inventory, with negative free cash flow reported in the prior quarter and ongoing cost-cutting measures including a 10%+ workforce reduction.

Strategic initiatives highlighted in recent calls include acceleration of new vehicle launches (including affordable models), expansion of AI and FSD (Full Self-Driving) capabilities, and scaling of the energy storage business, which reached record profitability.

Tesla is also advancing robotics (Optimus humanoid) and autonomous taxi (robotaxi) projects, with investors seeking updates on production timelines and commercialization.

Risks for the quarter include further EV demand weakness, macroeconomic headwinds (e.g., consumer sentiment, auto loan delinquencies), and reputational challenges linked to CEO Elon Musk’s political activities.

Options markets are pricing in high post-earnings volatility, historically averaging a 12% move, reflecting uncertainty around execution and growth trajectory.

Investors should watch for management’s guidance on new product ramps, margin recovery, and updates on key technology milestones, as these will likely drive post-earnings sentiment.

Cautious, incremental positioning may be prudent until greater clarity emerges on core automotive demand and progress in high-profile future initiatives.

ServiceNow, Inc. (NOW) - April 23, After Market Close

ServiceNow delivered strong Q2 2024 results, with subscription revenue growth of 22% year-over-year, operating margin above 27%, and free cash flow margin of 14%; guidance for full-year 2024 was raised, reflecting continued business momentum.

The company’s strategic focus remains on expanding its AI-driven platform, notably through new partnerships (e.g., with Microsoft for Copilot integration) and the rollout of GenAI-powered offerings like NowAssist.

Execution across sales channels has been robust, with net new annual contract value (ACV) and current remaining performance obligations (CRPO) both beating expectations, driven by strong direct GenAI sales and early renewals.

Profitability is benefiting from operational efficiencies and disciplined expense management, with the full-year operating margin target increased to 29.5%.

Risks for the upcoming quarter include potential deal delays or macroeconomic uncertainty tied to election cycles or broader IT spending slowdowns, though management notes that customers are leaning into ServiceNow’s solutions to drive productivity and cost efficiency.

The company maintains a strong balance sheet with $8.9 billion in cash and investments, supporting ongoing innovation and shareholder value creation.

Investors should monitor updates on AI adoption rates, partner channel expansion, and any signs of macro-driven demand shifts, as these will be key to sustaining premium growth and valuation.

Continued outperformance in subscription revenue and margin expansion are likely to be well-received, but any weakness in forward guidance or GenAI traction could weigh on shares post-earnings.

Meet Evan Buenger

Evan Buenger, Editor of the Bull and Bear Brief

From a young age, Evan was fascinated by the stock market. At just 11 years old, he received a Wall Street Journal subscription for his birthday, sparking a lifelong passion for investing. Evan spent his formative years studying the strategies and philosophies of legendary investors like Paul Tudor Jones, Stanley Druckenmiller, and George Soros, absorbing their wisdom and developing his own unique approach to the markets.

As Evan's knowledge grew, he began to incorporate the time-tested, technically-based strategies of trading legends like William O'Neil and Richard Wyckoff into his own investment framework. By borrowing elements from each and rigorously testing them in real-time, Evan created a powerful conglomerate strategy that encompasses fundamentals, technicals, and macroeconomics.

Today, Evan is a professional trader and was a top contender in the 2020 US Investing Championship. His extraordinary performance, with a 141.8% return, is a testament to his studious background, well-informed approach, and unwavering dedication to his craft.

At the core of Evan's strategy is identifying stocks that benefit from sector trends and rotation. By combining fundamental analysis with a focus on relative strength and advanced technical analysis techniques, Evan is able to identify the stocks that are most likely to move higher or lower over the intermediate term.

While he keeps a close eye on macroeconomic trends, his willingness to adapt to changing market conditions, as well as his developed ability to know when to and not to act in a fast-moving market, is what sets him apart. Evan has consistently demonstrated his ability to navigate even the most challenging investment environments. His impressive track record and unique perspective make him a valuable voice in the world of finance, and he is thrilled to have the opportunity to share his insights and expertise with subscribers of the Bull and Bear Brief.

Subscribe to Stock Portfolio Recommendations Newsletter to read the rest.

Become a paying subscriber of the Bull and Bear Brief: Stock Portfolio Recommendations Newsletter to get access to this post and other subscriber-only content.

Upgrade to Stock Portfolio Recommendations NewsletterA subscription gets you:

- One or more stock trades weekly to build your stock portfolio

- Weekly updates on existing trades so you'll always know when to close out your trades